This post explains what the government and central banks do in economic crises and how they step in to recover the economy. It’s about low interest rates, economic stimulus packages, injection of money into the economy and how the politicians and economists try to get us out of economic pickles!

When the economy starts to take a downwards turn, the government and the national bank (Bank of England) hop in quickly to try and fix things and get the economy moving again. To start, let’s quickly revisit what happens in a crash and what the government and bank can try to influence to keep the economy under control.

What happens in a financial crash?

In a crash or downward economic spiral, all the promised return on investments go down the drain. Suddenly, with no promise of return on investments, money becomes less valuable in its invested form. Instead it becomes more valuable in its cash form.

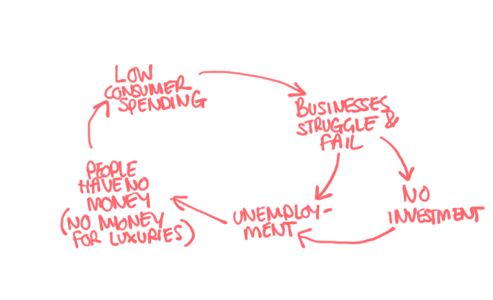

The negative economic cycles sees people lose a lot of invested money. Lost money or serious fear of loosing money leads to low consumer spending, struggling businesses, a lot of businesses that eventually have to close and no investment in new ones starting up, loss of jobs and huge unemployment which means even less people with money and less spending. The the spiral reinforces like I’ve shown below.

What do the government do in a crisis?

There are 3 main things they do which I’ll explain here:

- Reduce interest rates

- Giving out money

- Borrowing for bailouts

Step 1: Reduce interest rates

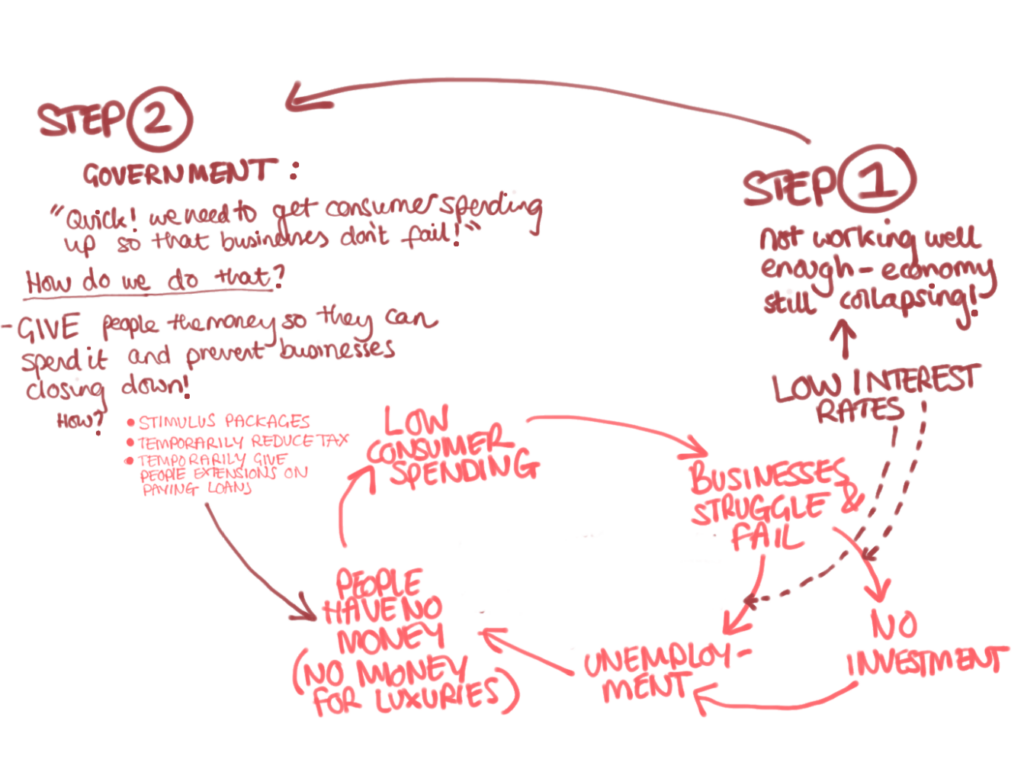

As a first step, when it looks like a downturn is starting, the Bank of England will reduce interest rates. The Banks of England’s actions are called monetary policy. A high interest rate is what incentivises people to invest their money. People get a lot more than they started with because of the interest they earn from whoever borrowed the money. With no incentive to invest money- there is more incentive to spend. (Doing nothing with their money just makes it lose value over time with inflation- if that doesn’t quite make sense don’t worry- not important here). The Bank of England hopes that by incentivising spending, it can boost the economy back into a positive spiral. I much prefer learning by diagram so I’ve tried to doodle this in the picture below.

.

Why reducing interest rates doesn’t always work

Reducing interest rates doesn’t always work. It might increase spending a bit but interest rates can only go so low. If reducing interest rates has already been done and the economy still seems to be spiralling down then it’s time for the government to step in urgently (using their ‘fiscal policy’). They’ll try to boost the down-spiral to make it positive again. The more people with no money who are unemployed (so not paying tax) and claiming state aid (so costing money to support), the more the government moves into a bad financial position. They won’t be getting money in from people and businesses through tax and they’ll have to spend more to support the people who are now unemployed.

Step 2: Giving out money

The Government urgently wants to boost spending to kick the economy back into action. This is a ‘hard ask’ when people are losing their jobs and have no money. So, they GIVE people money (sometimes directly and sometimes in round-about ways). They can do this by temporarily reducing taxes, by giving economic packages to families struggling or by giving people more flexibility like extending debt repayments. It’s not important to understand these things- just understand that all these interventions either give people money or save people expenses which means they have more money available to spend. Eventually, with people spending more, businesses will have customers, be able to keep their staff on and eventually employ more staff and create more jobs etc… The picture below shows this in play.

Some diagrams to help explain…

First the government step in and give people money (above). That ‘boost’ of money should (hopefully) lead to the start of a positive economic cycle (pic below!)

Sometimes, these measures of low interest rates and a big government spending interventions to put money into the economy and make the economy flow again do work, but that’s not all the government does in financial crisis times. Sometimes businesses and financial institutions (like banks) FAIL SO BADLY that they can’t be saved by higher consumer spending. This could happen if the crash has come about too fast. The governments strategy of slowly boosting spending and letting it trickle through the economy, improving the situation as it circulates takes time to work. If the crash is sudden, there might not be time. (Why am I talking about Banks not businesses? They both need flowing economies to make money- they;re not the same but in this situation they are similar)

Step 3: Bailouts for Banks or Businesses

Financial institutions (like banks) need consumer spending and a flowing economy to operate, but banks are (what many people call) “too big to fail”. Basically their finances are so heavily entangled with the financial markets that them going bankrupt would be more catastrophic for governments than just ‘giving’ them the money they need to sort out their problems. Sometimes this is just way cheaper than the alternative. So bailing out big companies is another thing banks do in economic crises.

For some countries with smaller economies, the fallout of their financial system failing is so catastrophic that other countries will be FORCED to give them the money they need to recover. This is what happened to Greece for example when their economy collapsed around the time of the 2008 financial crisis.

How do government afford bank bailouts?

The government bring in money from taxes. This means during times with little business activity and low employment, there isn’t much money coming in for them. So how do Governments pay for all the unemployment benefits, economic stimulus packages (and sometimes the bailouts)? They pay by borrowing money. From who? Some individual investors who haven’t fallen into the traps of the bad economy, sometimes other countries….but mainly from themselves (through a deal with the national bank). Yeah- it’s a bit tricky to wrap your head around. It works because government debt isn’t really debt as we understand debt. Also, government borrowing isn’t exactly borrowing as we know it. The media SO OFTEN mis-report on this. Systems are so much harder to understand when they’re not explained right! See our post about how government borrow money and whether debt is good for bad here

Hope you enjoyed this post about what the government and central banks do in economic crises. Have you learnt anything new? Please get in touch or comment below if you have.