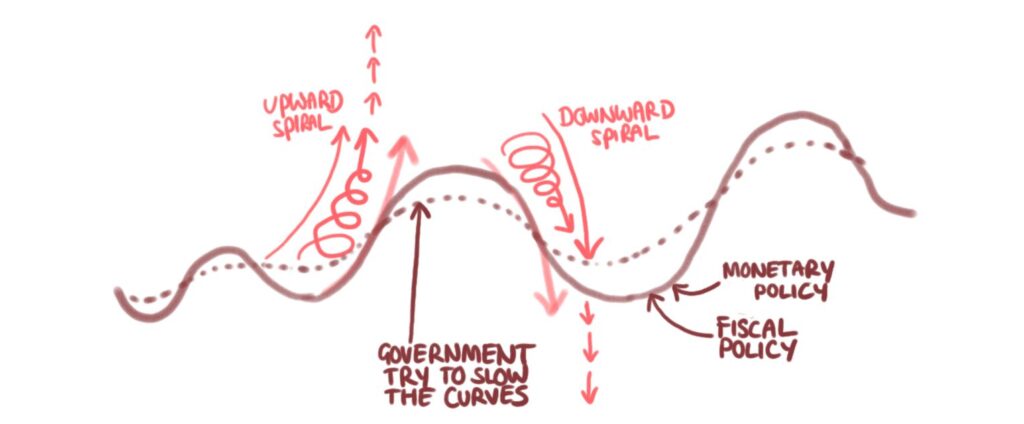

In this post I will explain what causes the economic peaks and troughs. I’ll explain what an unbalanced economy means and what can lead to economic crashes and crises. In the previous post, I introduced the business cycle and how the economy naturally swings from ups-to-downs. Now we’re looking at the economic cycle extremes and next we’ll look at what can be done to avoid crises.

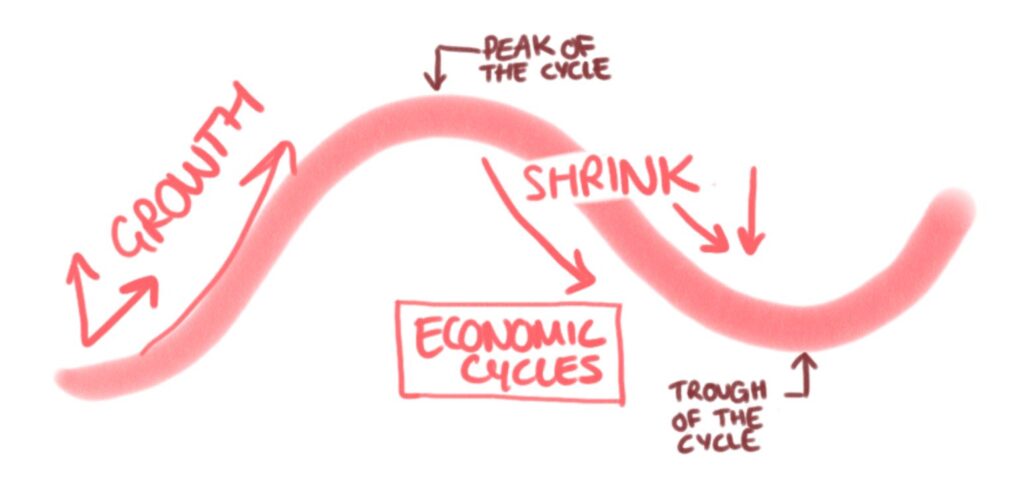

What causes the economic peaks?

The peak is the point where growth is at a maximum level. Often the economy at this stage has some unbalanced features that ‘wobble’ and make it begin to fall. We can’t predict exactly when this will happen. Even if we see that prices are rising in an unbalanced or unsustainable way, the exact moment they become too unsustainable is usually not clear.

People don’t just trade between supply and demand but also between hype and anticipation. These are the things that become unbalanced. If something gets overhyped and way more people hop on a bandwagon than should be, it’s an imbalance. When new supply is created to fill a hyped demand and then the hype stops, that supply is wasted. A ‘wasted’ supply is a sudden change in value to those items which is an imbalance.

Whenever there is anticipation of lots of wealth and shopping in the future but then inflation starts making things so expensive that most people can’t afford to buy, that’s an imbalance. An overheated or unbalanced economy is one that’s growing too fast for all components to catch up.

the unbalanced economy…

You can imagine these imbalances as a jenga tower. Each time a supply and a demand don’t match, or a hype and reality don’t match, a block comes out of the tower. At first it’s ok but when this happens too much the tower becomes very wobbly. Any slight movement like a hand gesture or a breath could cause the tower to topple. In economic terms the topple could be caused by one financial institution loosing money. This might send a shock around all neighbouring institutions. Any hint of uncertainty and funders or investors might withdraw, causing a cascade of financial crash (toppling the whole Jenga tower).

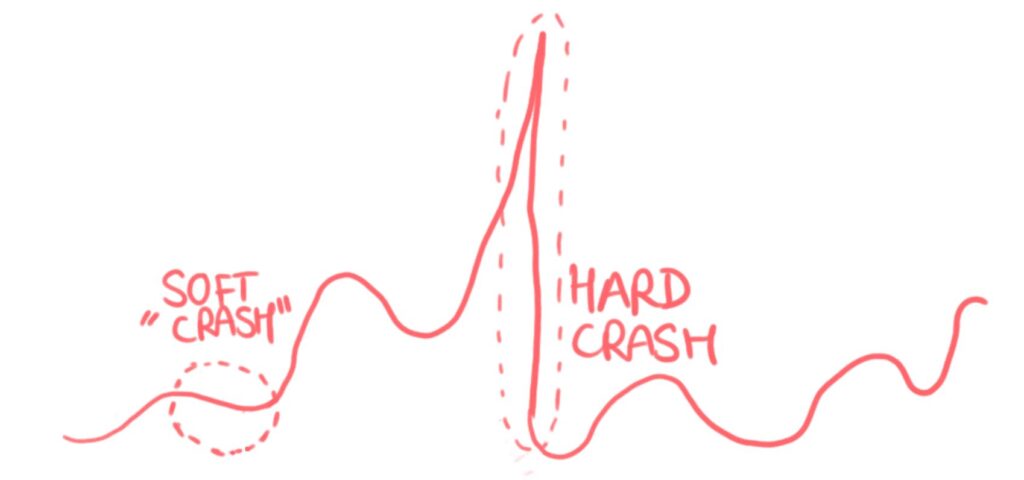

Economic shocks and hard financial crashes

There can be soft or hard crashes. In the best case, the peak comes about because the central bank realise that inflation is rising too fast. To try and slow it down so that people can keep spending and keep the economy running, they might increase interest rates. This slows spending and growth and leads the economy into a contraction phase. This is a more elegant transition.

What is a hard economic crash?

A hard crash comes when there is a huge imbalance and the economy very suddenly spirals down and grinds to a halt. The value of money an investments can change instantly overnight. Sometimes these imbalances are called bubbles. In the years leading up until 2007, there was an imbalance between the amount of mortgages people were offered on homes and the amount of people who were able to repay them. (actually it wasn’t the fault of the people taking the mortgages- it was the way the mortgage product was sold and who it was sold to- but that doesn’t really matter in this post example).

What happened in the 2008 Financial crisis?

The economy had been so strong for years and many people were so wealthy enough to want to buy more and more houses (this is the happy bubble of lots of people buying houses and lots of very generous loans being offered). The bank can only lend mortgages (loans) when they know that the loan will be repaid. They do it because they earn extra money from the interest on that loan. It’s an incentive to lend out more when it seems like the economy is growing well – they stand to gain more. The economy could not grow fast enough for enough people to repay these loans….and those imbalances toppled the whole global financial system. As soon as the economy began to turn in a downward spiral, more and more people became unable to pay and banks lost more and more money, pulling down all financial institutions around them.

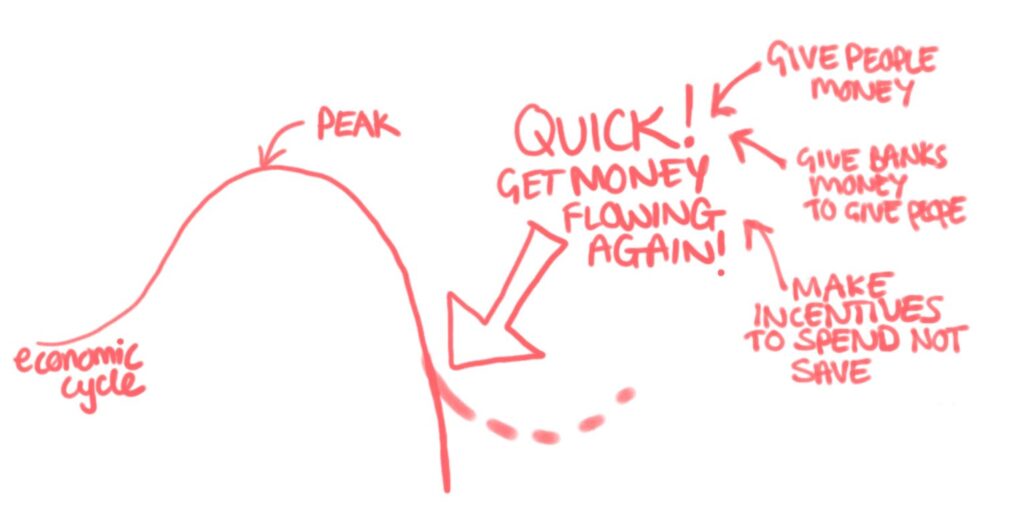

What causes the economic trough?

The trough (bottom dip of the curve) begins when the unemployment rate reaches its lowest. As we will learn in the post on what governments do in times of recession, the central banks of a country will often intervene and inject money into the economy to try and stimulate growth. The trough is the point where that injected money stops the downwards spiral and begins to change things around.

Hype bubbles in an unbalanced economy

‘Bubble’ is the name for any part of an economy that is over-hyped compared with the rest of the economy. In the 2008 crash it was a ‘housing bubble’. In 2001 there was a ‘dot com’ bubble that burst and caused a recession. More recently there was a bubble in ‘bitcoin’ that burst and many investors lost money. One bubble bursting in one sector doesn’t have to destabilise and cause a massive global financial crisis (bitcoin didn’t when it crashed in 2018) but the longer the bubble grows and the bigger it gets the more dangerous it becomes. Remember the unbalanced Jenga tower? The more wobbly the tower is at the time of the bubble crash, the more chance the bubble has of knocking it over. An already unbalanced economy is more susceptible to chaos.

If you like Ryan Gosling, Brad Pitt, Steve Carell, Christian Bale or Margot Robbie then there’s a really good movie called ‘the big short’ that is all about the mortgage crisis and two men who saw it coming and made millions betting that there was a bubble that was about to burst. It has similar movie vibes to Wolf of Wall Street or The Social Network if they’re your thing.

Thanks for reading!

I hope that was a helpful post about the extremes of the economic cycle and what happens when there’s an unbalanced economy. Join the mail list for latest post and get in touch to tell me what you think of these posts! Are they helpful in understanding?