The way that the media talk about government debt and money borrowing leads to misleading (and maybe also ignorant) reporting. Debt is not always a bad thing- when someone gets their first mortgage you celebrate, don’t you? It’s a positive step in someones life. It’s a step towards a stable, fruitful future. There are times when the government is in huge debt but the economy is growing well and living standards are good. There are times when debt is low but there’s huge unemployment. The actual amount of money is an awkward thing that doesn’t in itself tell you much about a countries prosperity. The story of where your money is from, what you’re doing with it and how it will develop in the future is the interesting bit.

This post will look at 3 types of debt- that can be constructive or destructive. We look at how government debt works, why it’s bad and why it’s good.

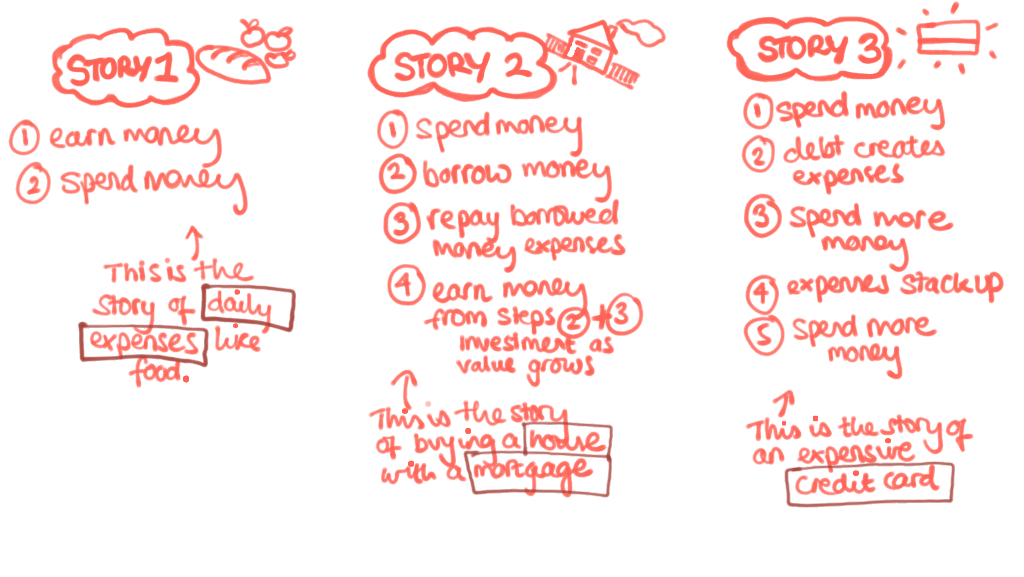

Look at these three money scenarios as analogies for how different types of debt work:

Story 1- The Daily Expense (no debt):

The first story is similar to what we know about personal spending for daily expenses like food. We earn money and then we spend it. The more we earn the more we spend. Simple- we get it.

Story 2- The Mortgage (g0od debt):

The second example is like getting a mortgage (house loan) to buy a house. We spend a bit of our money and borrow a lot of money. We put ourselves into debt with the Bank. To get out of debt to the Bank, we work hard to re-pay our mortgage. Our house value rises and we save money on rent as the longer this continues the more money we save and make on the investment (in other words, the more money we earn!). The story is, we spend money, then we borrow money, then we earn money.

Story 3- The Credit Card (bad debt):

The third story is the story of the credit card. We spend more money than we have. At first we pay off minimum payments. We keep spending money and become liable for repayment fees. Then spend money on repayment fees. We keep spending money. We don’t increase the money coming in. Eventually this leads us to spiral into debt that keeps growing. The story is we spend, we go into debt, debt forces us to spend more (in repayment), we do into more debt.

In the mortgage example, our debt will eventually make us more money. In the credit example, debt will keep growing and lose us more money as the payments stack up on top of each other.

Does the government have a limited budget?

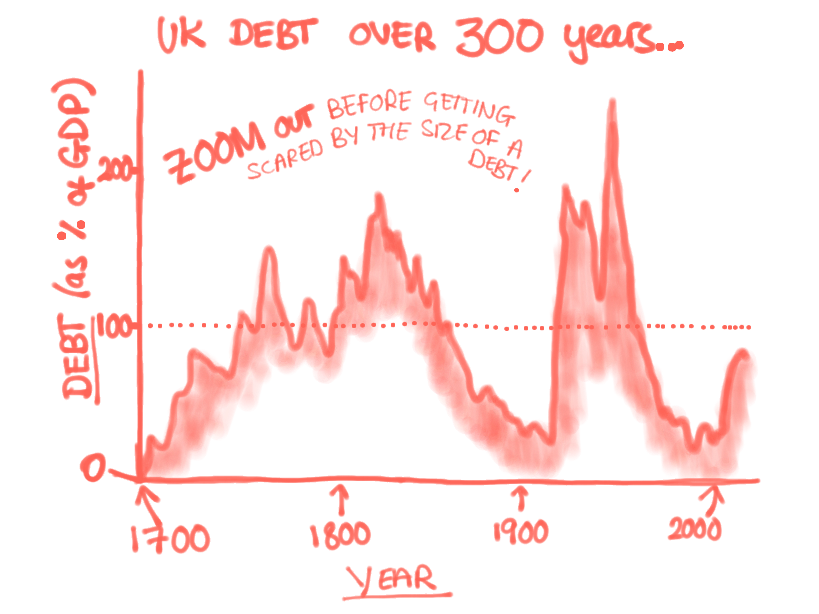

Let’s go back and look at government spending and the story they tell us. They often talk about having a limited amount of money. They need to ‘earn’ or ‘collect’ money before they are able to spend it. This narrative is backwards – governments are always leveraging debt – they never have a surplus of money. The government have always been and will always be in some level of debt because of how our financial system works. The USA, the worlds biggest economy, is in huge amounts of debt.

“Governments have no money…”

When the government says ‘we have no money’ that’s absolutely true. They’ve never had money. They’ve always been in debt. Britain colonised the world in debt. Britain started the industrial revolution in debt.

When the government says ‘we can’t just invent money to spend on something’, that’s absolutely wrong. They do it all the time. They can’t magically make billions and spend it away on something frivolous because they’ll be seen as untrustworthy. This would mean no-one would want to invest and no one will want to invest in them (for example by buying bonds…see my posts on Quantitative Easing). But governments can ‘borrow’ or ‘invent’ cheap money for themselves anytime to invest in things that will be productive for the future development of the economy (like a mortgage debt is productive to an individual).

How do governments afford public spending?

The question we need to be asking the government is not ‘how will you pay for that?’ because- the answer is so easy- they’ll either use tax income they’ll issue bonds to borrow the money.

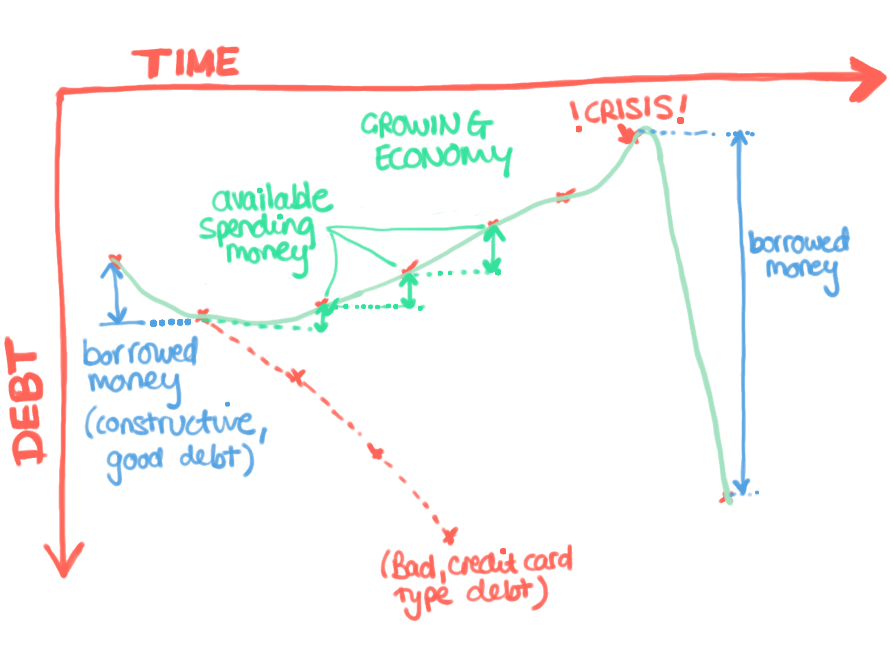

The questions we should be asking are ‘what financial returns can you expect from that investment?’, ‘what social or environmental returns can you expect from that investment?’, ‘will that investment boost or reduce the country’s reliability?’. In other words, we need to ask ‘are you creating a ‘mortgage debt’ or a ‘credit card debt’?’.

Since all governments are operating within debt (as in everything they spend just increases or decreases the debt- it doesn’t ever pay it off), they never actually earn or spend money, they only every earn and spend debt or in other words, promises of future money (that’s what debt is). These promises are more complex than a balance sheet. The promised depend on reliability, hope, speculation and trustworthiness.

Why is government debt bad?

Government debt in itself is never bad. It can be bad in the following 3 cases:

- It becomes susceptible to very high interest payments. This is a risk of sitting in a lot of debt with no imminent plans to boost the economy. IF you take out debt while interest rates are low, there will be a lot of uncertainty about the future is the monthly repayments for owning that debt shoot up. Having debt is no problem. Having high interest is expensive and will use up money that could be better spent elsewhere (schools/hospitals etc).

- Poor reliability gives less financial control. If governments are irresponsible or unreliable they will have fewer people interested in buying their bonds. When they are in a serious crisis, they won’t be able to generate money as no one would want to buy the bonds they sell. They may get in trouble with financial regulators

- It is clearly not going to make positive change (eg corruption). If government debt is not being invested in the country then of course it’s bad because there is no benefit-it just holds the two risks i explained above.

Why is government debt good?

When a country to be in a bad position using debt is an essential tool to get out of the pickle. Government spending has huge power to create a highly skilled workforce, investment opportunities, loads of jobs, efficient services for high productivity, brilliant living environments for strong metal health and flourishing ideas markets. So really, the downside of a government having debt is only if it hinders their ability to borrow in the future. And this happens when borrowed money is invested in a way that doesn’t lead to great financial, social and environmental gains.

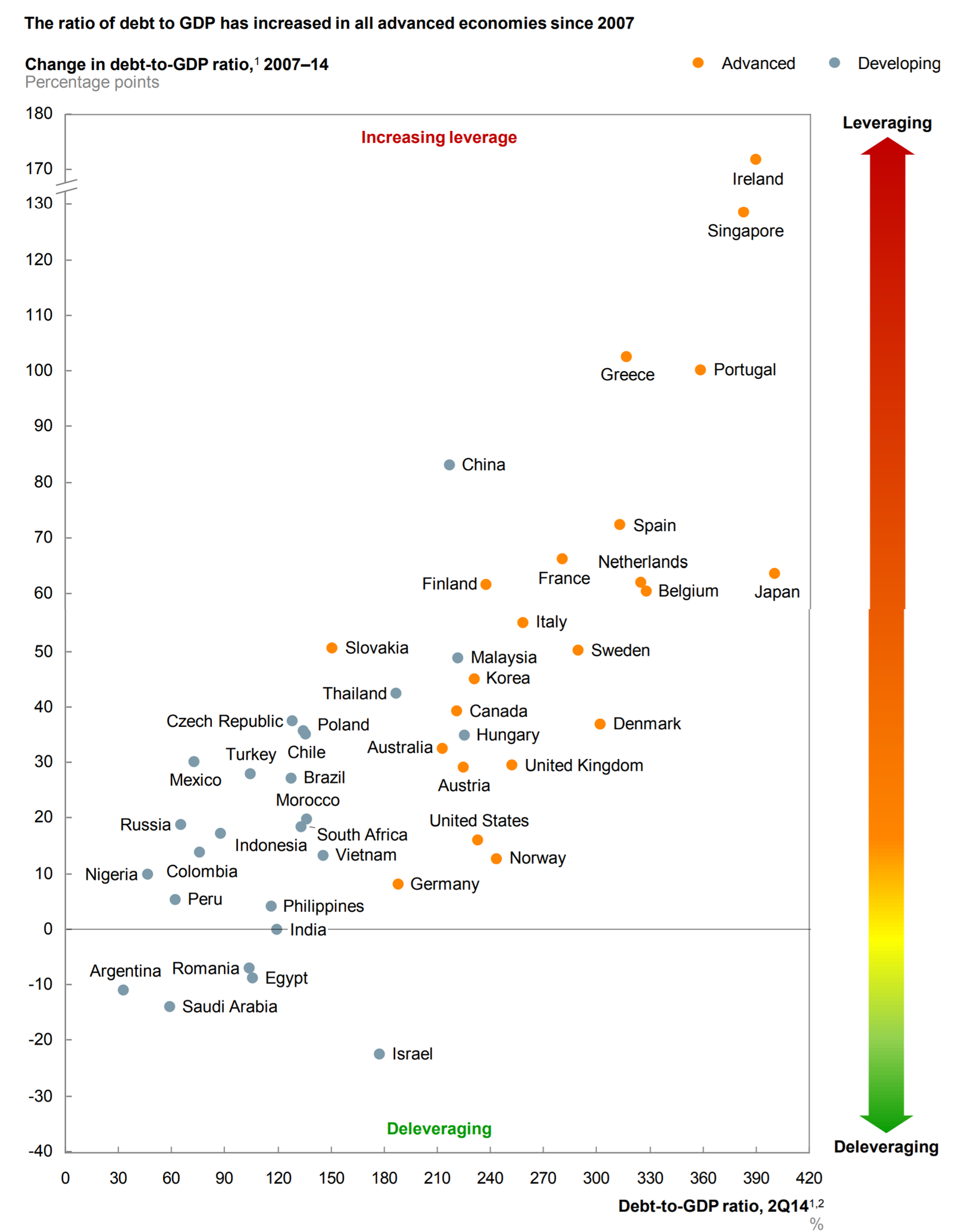

Here is an image from McKinsey about the debt and change in debt of countries after the 2008 financial crash. Along the ‘x axis’ or as you look towards the right you’ll see the amount of debt a country is in. For example, Japan, Ireland and Singapore are in the highest amount of debt. Nigeria and Argentine have very low debt. When you look along the Y axis (up and down) it’s the amount that debt level changed during the crisis. For example, Ireland, Singapore, Greece and Portugal each took on a huge amount of debt during the crisis. In contrast, Israel and Saudi Arabia actually reduced their debt. Do any of these surprise you? Do they suit the impressions you have of economies?

Thanks so much for reading my post about government debt. I have another post here on how the government borrow money (and who they’re borrowing from) that might interest you.

- https://www.mckinsey.com/featured-insights/employment-and-growth/debt-and-not-much-deleveraging