We hear about government borrowing in the news, but sometimes it’s hard to relate what we listen to in our everyday lives. Sometimes we want an answer to the simple question: How does government borrowing affect me? So here is my take on the personal consequences of national economic policies

How does government borrowing affect me?

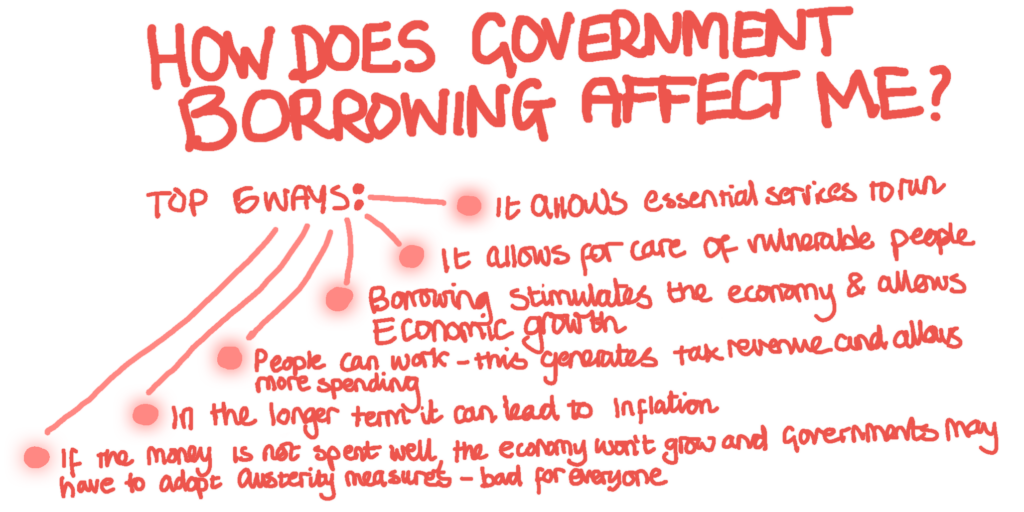

The top 6 ways that government borrowing affects me and you:

- It allows essential services to run

- It allows for care of vulnerable people

- Borrowing stimulates the economy allowing for economic growth (good for everyone)

- People can work, generating tax revenue for the government, enabling more spending

- It is good in the short term. In the longer term, it can lead to inflation

- If the money is not spent well, the economy will not be boosted, and there will be a bigger chance of the government having to cut spending, which is bad for everyone

Why do governments borrow money?

Governments need to spend money to run their countries. They spend money on education, healthcare, policing, infrastructure, care for the elderly, culture, and other things essential to running a country. When people are in desperate need (for example, they have lost their jobs or can’t afford to feed their children properly), the government pays for free school meals and gives them living money until they find somewhere.

Governments mainly make money from tax income. The government could, in theory, generate enough money from taxes in order to cover their expenses. There are a few other political reasons that make government hesitant to stimulate the economy. The key principle is that governments raise money through taxation to spend on the people and services in the country.

What are the effects of government borrowing?

When the government borrows, they are about to spend and invest the money on service in the country. So government borrowing itself is great if it’s handled well, and the risks arise if it is mismanaged.

There are two main streams of thought about how useful it is to borrow lots in a recession. Keynesian theory says that increasing government spending will boost the economy by increasing the demand for goods and services. This increase in demand can help to increase productivity and employment. In other words, injecting money stimulates growth.

More classical economics warns that if the government spends more, rather than stimulating the economy, it’ll just push resources further into the more productive private sector than keeping it in the (in their view) less productive public sector.

So the initial effect of government borrowing for spending is that more money will be invested into the country, and more money will be invested into the country, and the immediate effects will be good. Following on, there could be two outcomes. The first is excellent, the spending boosts economic growth, and the country prospers. When the country prospers, employment, job opportunities and all sorts prosper, which benefits everyone.

If the policy doesn’t work, the alternative is that the money will be mishandled and lead to a high budget deficit (and debt). Suppose the increased spending doesn’t boost the economy. In that case, there will have to be severe spending cuts to counteract the additional expenditure and reduce the deficit. This is a risk to everyone, as outlined in this article.

Why are governments in debt?

Being in debt is not necessarily bad for a government, as all world governments are in debt. Because they are in debt over long periods, and no creditors are ever going to come and catch them- it doesn’t necessarily matter whether the government are in debt or credit. What matters slightly more is the cost of the debt they are in and the budget deficit (the yearly difference between what they spend and what they take in) if they are in a period where the debt costs are high.

They are all in debt because governments act as the ultimate insurance policy for the people of a country. When a disaster, like a financial crash or a global pandemic hits, governments are left to underwrite the cost. So, even if spending matches income each year, they will, over history, always end up in a place of negative money.

Government debt (or national debt / public debt) is different from the private individual debt that we might experience. In the United States, this happens at a federal level. So, terms like federal debt are taken on by federal governments. States and councils have their own finance mechanisms (councils have their own finance mechanisms (a different topic).

How do governments borrow money?

Governments borrow money by issuing tokens (like IOUs) called gilts. These are little tokens of debt that the government puts itself into to quickly get the cash it can spend. Investors buy the gilts, and they get the IOU with a promise of interest in the trade. Governments get the income from selling the gilts immediately.

I’ve have another post on how governments borrow money that explains this in a it more detail.

Who does the UK government borrow money from?

Who buys these government gilts? The government gilts are a good deal for many investors. They are a low-risk investment with reasonably secure and reasonably good returns- clearly, they’re worth buying; otherwise, the government wouldn’t be able to sell them. They’re available to anyone to buy, but the majority sold on the private market will be purchased as long term stable investments. They’re usually purchased by big pension houses or insurance companies.

However, there is another mechanism in which the government borrows money. This is how it generates massive amounts in a very short space of time. This is when the government makes a deal with the central bank of a country (such as the Bank of England or the federal reserve in the US) and issues many gilts that the banks promise to buy. This exchange of IOUs in an agreement rather than on the free market is a slightly controversial monetary policy, but it happens all the time. The process is called quantitative easing.

Why do governments borrow money instead of printing it?

To print money is to do something covert and untrustworthy. Rather than directly printing money (or, since this money is generated digitally, typing a multi-digit number in the credit column of the national bank account), they do a sly operation called quantitative easing. The Bank of England lends money to the government in exchange for interest rates. That money is returned once the gilt expires. But then the Bank of England doesn’t ask for all the money back, or it cancels the interest payments. In doing so, money has effectively been generated out of nowhere, but because it’s a bit under the radar, it’s slow and is easier just to make happen with little consequence. Both Institutions can save face and retain the trustworthiness other investors expect of them

Conclusions- how does government borrowing affect me?

How does government borrowing affect me? Government borrowing usually means increased government spending is coming. Government spending means that services can run and the vulnerable can be cared for. This spending is designed to boost economic growth, which means more jobs, better work opportunities, and more money flowing generally. This means more jobs, better work opportunities, and more money flowing, generally seen as great.

In the short term, borrowing is a sign of good things. In the longer term, if the money is not spent effectively and the economy does not get the boost it expected, there could be a big budget deficit. This would mean very harsh fiscal policies would be put in place, such as severe spending cuts that would have terrible effects on the country’s people. High government spending can also lead to higher than usual inflation in the future once the economy is back on its feet. It ultimately depends on whether the plan was successful in stimulating economic growth that is then reflected in GDP (gross domestic product).

Hopefully, this was a useful overview to: how does government borrowing affect me? You might enjoy these posts to explain some key concepts here in more detail.