What are the very basics of understanding economics? When I first googled this, all the results showed economics buzzwords like supply and demand, scarcity, elasticity, economic indicators, gross domestic product, the market economy, etc. I don’t find these types of texts helpful. I want to understand economics intuitively. So here is my alternative description for you.

The economy is all the flows of money and products in a country. It can be on a macro-scale (macroeconomics) where it’s about the global flow of money, or, it can be on a micro scale where it’s about the flow of money into an individual company (micro-economics). The key principle to understand is that money flow is what makes the economy.

My 5 key concepts to understand economics intuitively are:

- The economy is the flow of items and money between people, businesses and banks

- The state of the global economy is what determines how much flow there is

- Flow creates more flow, so if the economy is flowing, its growing. A growing economy is good for everyone’s wealth

- Where the flows are happening determines which direction the economy is headed in. The direction is determined by the theory of supply and demand. The theory says that flow will naturally move in the right direction.

- Although most of the speculation for where the economy is heading comes from the stock markets, the government can influence the economy and slow the flow or speed it up if necessary. They do this through tools like changing interest rates.

What flows in an economy?

Understanding economics is a matter of understanding what flows in an economy. Economies trade in two main things. The first, is items. Items flow into and out of a country and also between shops and consumers within a country.

The second thing is money. Money is traded from big companies to banks, to employers. Sometimes the trades are simple, like salaries. Usually, though, the trade is by lending and borrowing.

When you deposit money into a bank as savings, that money is available for the bank to invest in the stock market (which means investing in shares of companies). The banks do this to make money. They pay you interest for the savings, and they get payments (called dividends) or an increase in the value of the share (which is the capital gain). All this illustrates that in the trade of money, the interest rates and dividend/capital growth prospects are the things that determine how money flows.

People buy stuff when they want it and when the price is right. The economy is what sets the price of items, which means the economy determines the economic value of an object. Understanding that the economy is the flow of items and money between people, businesses and banks is my first step to understand economics intuitively.

What makes the economy flow?

So, the economy is about the flows of items and money. The next logical question is when things flow and how they flow.

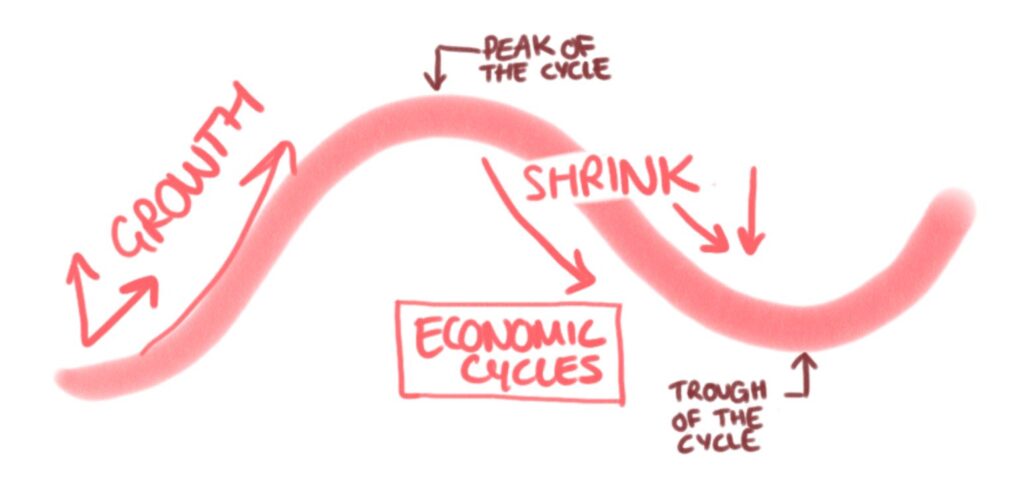

There are two main stages for an economy; growth and decline. It’s usually in either growth or decline of its tipping between the two. The difference is that growth means there is lots of flow, and decline means there is not much flow.

The idea is that while there is money flowing- it’s easy to make money, people are willing to buy/invest, and the more money and items are flowing, the better it is for the makers, the consumers and all the services in the economy. More growth, more money flows down, people have more money and more money to spend and that money they spend cycles back to businesses and helps them grow more.

The counter scenario is that when there is little activity- people are more careful with spending as there is less movement. Less activity means businesses have less money, so they don’t expand or grow as fast. I have another post that explains the process in more detail.

So how is it determined where people spend their money? I’m about to explain how the economy sets prices and how pricing directs the flow of the economy. Understanding growth, decline and economic cycles is my second point in order to understand economics intuitively.

How the economy sets the price of items

The economic principle ‘supply and demand’ sets pricing in the economy. We’ll explore this intuitively without any maths.

The price of items is the buffer that regulates the flows. If loads of people want something, and there is high demand and low supply, the cost will go up. The higher price will drive down the demand becasue consumers will think items are too expensive. If there is a considerable amount of a product and not too many people want to buy it, the price will drop. This interconnected web of different things with different values relative to each other is the basis of the economy.

Because the supply goes where the demand is, the resources in an economy will naturally be directed where they are needed. For example, if there is a shortage of a certain type of food, let’s say milk, something most people use, there will be a high demand relative to price. This means the money and activity will flow to the area and might enable more investment/new staff or general growth to combat the low supply.

A contrary example: there’s no point producing CDs if people are no longer interested in buying them. As people stopped being interested, CDs were still being produced so ‘supply was outstripping demand’. More supply than demand means the price is low. People might be more tempted to buy what remains because of the excellent price. Still, it doesn’t do the CD trade sector any good. THe CD sector can’t invest in growing their business; eventually, it will be more cost-effective to reduce production. The industry will naturally decline because the demand has gone elsewhere.

What does the government have to do with the economy?

Different governments in the world have different levels of control over the economy. The government’s responsibility is to provide basic living conditions to the citizens. In times of economic decline, people lose jobs and can’t afford food, making it necessary for the government to step in and help them. Better still, at this point, the government can control the natural flow of the economy to stop the decline. It does this by changing interest rates. I have another post on this here.

In doing so, the government tries to stimulate growth again artificially. In extreme cases where even this doesn’t work, the government will create money to put into the economy in a process called quantitative easing.

What does the stock market have to do with the economy?

The stock market’s main influence on the economy is the signal of confidence it sends. The stock market is where shares in companies and other financial products are bought and sold. The most famous stock market is the New York stock exchange on Wall Street. When the stock market completely crashes, it’s disastrous for economies worldwide. We remember these extreme events- such as the crash in 2008. There were clear signs that the economy was in a disaster. However, smaller cycles of ups and downs happen all the time, sending interim signals of confidence about the economy. (I have posts describing this in more detail here)

When the stock market is good, people with investments are wealthier, and they are able to invest more/leverage more and take bigger risks that fuel economic growth. The name for the number of shares or financial products you own is equity. Growing stock markets mean equity owners do well and keep investing and stimulating the economy in all areas. These trades don’t happen on a product itself. They happen based on speculation of how well a particular financial product or share in a company will perform in the future. Because all these trades are happening on speculation, the influence the stock market has in showing the confidence of how current shares will grow is enormous.

Summary- how I understand economics intuitively

So, what are the basics to understand economic intuitively? Three main things. Firstly, economics is the study of the flow of money and items. When money flows in the economy, everyone is better off, but it’s unsustainable. When the money stops flowing, people lose money, spend less, lose jobs etc. Secondly, the supply and demand theory indicates where money will flow to, what areas will get more economic activity, and which areas will decline naturally.

Thirdly, the economy is based on a lot of speculation. This speculation often comes from the stock markets. On the one hand, bankers and economists make decisions that affect global economics. On the other hand, the government gets involved in protecting people when there is a risk of people losing out. For example, if costs is so high, there is no food. Or if there’s high unemployment.

So this is my summary of the basics about how the economy works. However, it’s still hard to see how this might relate to a person’s life in the real world- for example, how does this impact personal finance? what about the ‘job market’?.

I have a number of posts about key economic concepts, explained hopefully in a simple, intuitive way, you might want to check out.