Economics and personal finance are both to do with money…one is on the huge scale, and one is on the tiny individual scale.

But is understanding economics important for personal finance? I’d say not really. You need to understand what parts of the economy are relevant to your everyday life. It’s nice to know what’s going on in the economy just for interest and to understand how the country works. But unless you’re working in personal finance, advising others- you can do just fine to get a really good start on personal finance on your own.

What is personal finance?

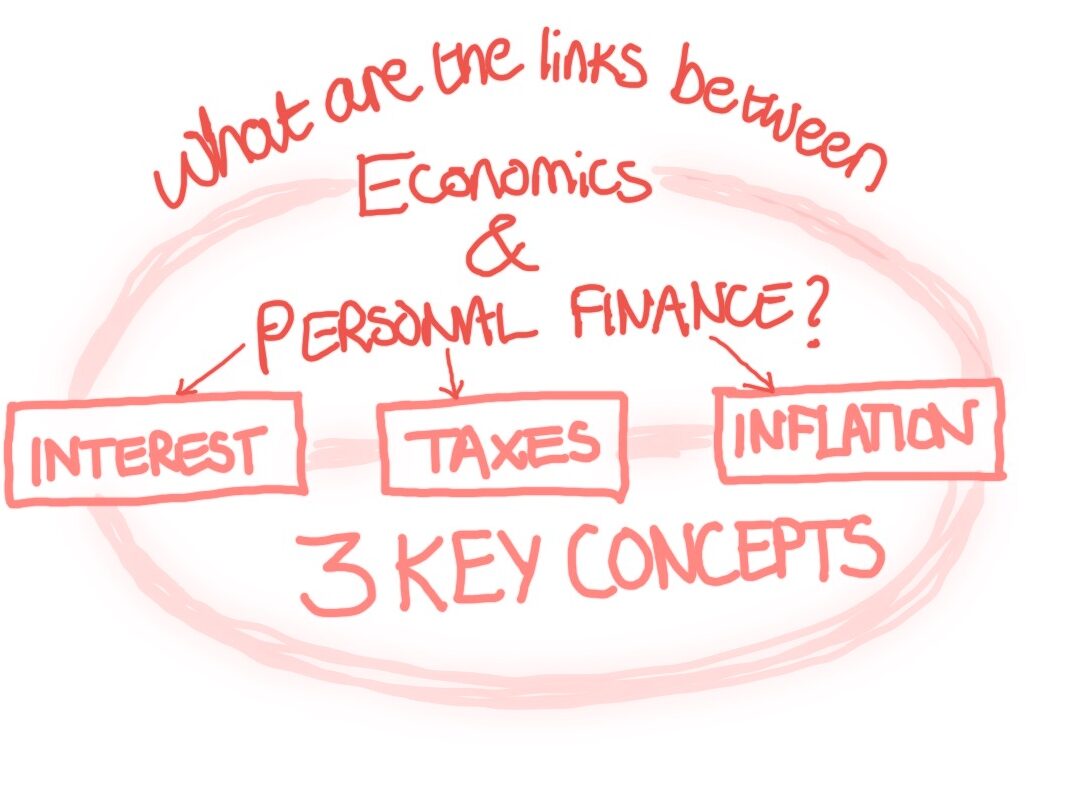

Personal finance is the matter of how you manage your money. To do this there are just three simple concepts to know:

- Interest

- Taxes

- Inflation

These are economic concepts, but you don’t need to understand how interest rates are set. You can just google what they are and go from there; it’s straightforward.

I’m going to describe the three main concepts to you here. This is information about personal finance, not advice. For advice, seek a professional.

1. How does interest affect my personal finances?

Interest is a payment on money that is borrowed. We wouldn’t have interest if we earned and paid for everything in physical cash. But we don’t- we deposit money into banks, banks lend us money in the form of mortgages, over drafts or credit cards.

If we put money into a bank, that money is available for the banks to use however they want so long as they return the same amount to you whenever you ask for it. The Banks invest that money to make even more money off it. And they want you to bank with them because the more money (capital) they have, the more they invest and the more they can make. To entice people to deposit money with them, they offer interest rates. “If you deposit your money with us, we’ll offer 2% of the amount a year as interest. That means if you only deposit for a year, you’ll come out with 2% more money than what you put in.

The same is true of credit cards but in reverse. Banks charge you money if you borrow money from them to pay for something (like you would if you were using a credit card). You then owe interest payments to the bank. If you borrow money for a house, the interest payment you’re paying the bank is your mortgage.

Payments, similar to interest payments, can also come from bonds or stock market investments. The idea is the same, you earn monthly income from being in a position to buy bonds or invest money, and as that money grows, you make small percentages of the profit. In the stock market, it’s called a dividend.

How interest rates affect financial decisions

So the principle of interest rates for your personal finance is to get the best interest rate (or rate of return for bonds and stocks), and to make sure you’re receiving interest payments, not paying them. For example, if you’re investing in the stock market, you might be making 10% a year…but if you’re paying 33% on an old credit card- you’re looking out. Best pay the credit card off first and then invest. Similarly, if your mortgage rate is 5% that you’re paying the bank, and your money is in a savings account in the Banks earning 1% it would make sense to pay the mortgage off immediately as early as possible.

On the other hand if your money i in the stock market earning 7% return, it’s still worth leaving it there because you’re earning more off it that you’d save by paying off your mortgage as son as possible. (There are a few caveats to mortgages. Depending on the value of the properly, the mortgage you have and a few other factors. That is something a financial advisor would be able to help with)

That’s the principle- it’s simple isn’t it.

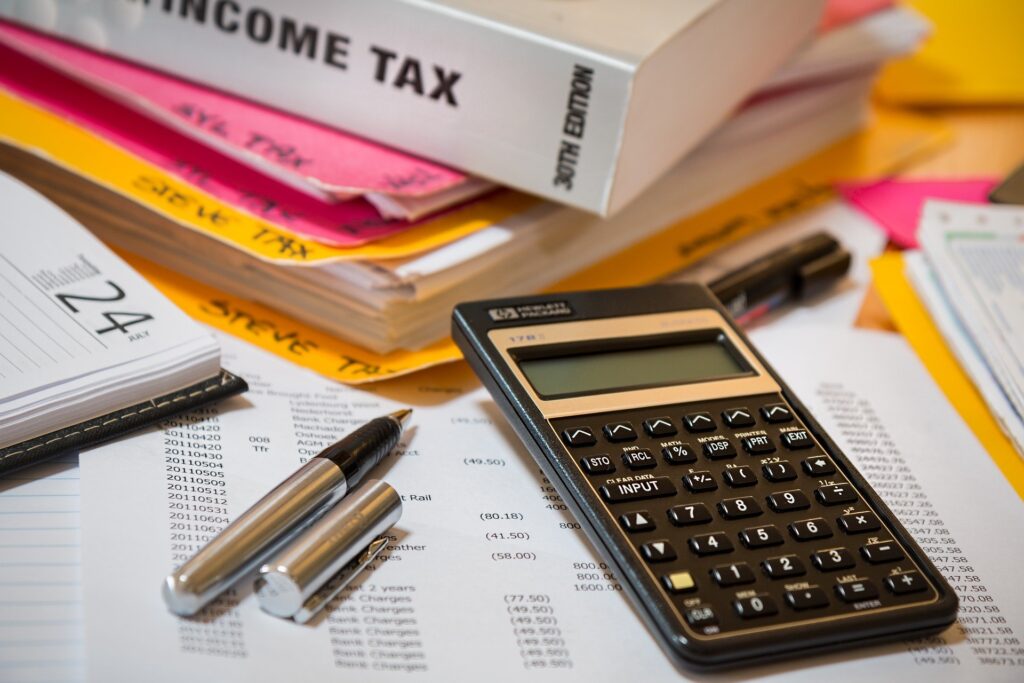

2. How do taxes affect my personal finances?

One of the main things you do in personal finance is to use your money in a way that it will be taxed the least. In a completely above board, legal way, you find methods that will save tax. There are certain things you can do with money to avoid it being taxed.

Governments leave some areas untaxed to incentivise behaviour in that area. One of the areas you can avoid tax is by putting your money into a pension. When you get a salary at the end of a month, any amount you pay into a pension is not included in the amount you’re taxed on for that month.

This is particularly helpful if you’re a higher band income tax payer. Usually at the end of a month you’ll get your salary and the salary will be taxed around 20% for everything below about £50k/year. Any pound earned above that is taxed around 40%…and then 45 when you earn even more (but that affects a very small percentage of the population). At the other end of the scale, you get the first £18,000-ish tax free.

If you’re earning £55k and you put £5k into your pension, you never have to pay the 40% tax.

Other taxes you can avoid

Those examples are income taxes. Then there are all sorts of other taxes that each have their own mechanisms that, with a bit of research, will have special ways to avoid.

Inheritance tax, for instance, is paid when someone dies, but if the money is paid 7 years before someone dies- it’s just considered a gift and is not taxed. So if people have money they know they want to pass to their grandkids, they can do while they’re still relatively young, before they are in the last years of their life. That money will be tax free.

Other tricks involve putting money into an ISA which is tax free.

There is a point if irony though. For the country to work well, the wealthiest people have to pay their taxes. Proportionately, it is their tax money that will make by far the biggest difference. However, the government leave a lot of loop-holes in the tax system. And it’s also the wealthy that can afford the excellent lawyers to do the work in avoiding the taxes for them.

3. How does inflation affect my personal finances?

In this post on economics and personal finance, we’ve already talked about wanting to maximise interest payments or bond repayments and avoid paying taxes. The other big threat to the value of your money is inflation. Inflation is the purchasing power of money, in other words its how much you have to pay for a certain amount of stuff.

Inflation rises over time, which means that the amount you can get for your money decreases. £100 today is worth less than it was 50 years ago and more than it will be in 50 years. The Central Bank, (like the Bank of England or the Federal Reserve in the United States) has a job to try and control inflation; keeping it at a rate of 2% per year. Sometimes it’s higher and sometimes it’s lower. That is because of how the economy is looking, though that’s not particularly important here.

What’s important, is how inflation will affect where your money has the most value over time. You wouldn’t want all your savings in a bank account gaining 1% interest when inflation means your money decreases in value each year by 2%. You can think of it as a +1%-2%=-1% sum. -1% means your money loses value over time. In the past 10 years interest rates have been so low- you’d be lucky to get even 1%.

How can you avoid the effects of inflation?

It is essential to have some cash savings. But after that, low risk investments in bonds or on the stock market are the only things that will beat inflation in this climate. This could sound scary to many people who imagine a stock exchange as a manic trading floor, like in the movies. But there are many financial options. Good ‘starter’ options can be bought online as easy as if you are ordering something on eBay.

They are low risk if you understand just a few basic principles about investing. Still though, super low risk index funds can have average return rates of 7% (which is the same if not better than most funds out there).

There are always individual circumstances that might favour different personal finance options. Some people get more mileage out of their money by property investing. And there are plenty of other things you can invest in- but for the average Jane, there’s not need to worry about all the other options. That’ the approach I take. And if you have money that is currently not beating inflation, I’d always recommend speaking to a financial advisor. I have learn’t what I know about personal finance from books and off the internet. My posts on personal finance share what I have learned and how I manage my finances. These might be a helpful starting point, but everyone in on their own journey- in life and finances!

I hope this post on economics and personal finance was helpful!

People who study economics don’t necessarily learn about personal finance. People can go through years of school, university and employment and never study the importance of economics and personal finance or how they’re related. They have questions that could be considered so basic, but financial literacy is essential! The knowledge of how to spend, save and invest set’s people up for life and for a healthy retirement. There are certain things about how the economy works that should be a key part of financial education. This post was written to draw some of these concepts together.

You may enjoy these other economics posts: