What is an economic cycle?

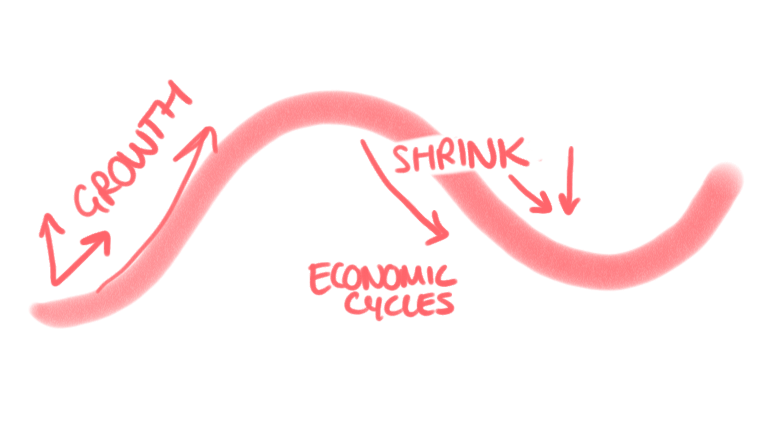

The economic cycle (or business cycle) is the ups and downs of buying, selling, lending and spending. These are the activities that make up the economy.

To assess whether the economy is in a state of growing (considered good) or ‘shrinking’ (which is considered bad), there are 4 key factors we measure. These factors are:

- GDP (Gross Domestic Product)

- Interest rates

- Consumer spending

- Employment rates

I’ll quickly describe them so we can understand how they are related and then we’ll see them in action, building two reinforcing, spiraling cycles that take the eocnomy up and down.

These spiraling cycles are the coolest imagery for how economics works. From these images, you’ll get the principles behind most of the debates the governments have. (and you’ll be set up for the next jigsaw piece of the economy puzzle- of how ‘crashes’ happen and how they can be “solved”.)

1. What does GDP mean?

GDP stands for Gross Domestic Product and is basically just a number that indicates the general overall ‘health’ of the economy. It’s a loose measure of how much is being ‘produced’, but that’s not super important here- all that’s important is that a positive number means growth and that’s good. If the number is low or negative- it’s bad. More on GDP in this post here.

2. What are interest rates?

Interest rates are the amount of interest you’ll get on savings in the bank, or the amount of interest you’ll have to pay on a loan you take out. Imagine Interest as a compulsory tip when money is lent- if you lend your money to the bank by depositing it there, the bank repays you with a bit extra when you take it back out. If you borrow money from the bank to start a business you will pay the bank a bit extra when you return the money. The difference is that interest is not a one off like a tip- its a percentage of the amount for each year the loan is taking place (so if the loan happens over 10 years at a 2% rate you’ll get a 2% tip each year).

The central bank of a country sets the interest rates. If they are high– there is big incentive for people to save and invest money because they’ll get a very large ‘tip’. If they are low, there is less incentive to save and more incentive to spend. (This spending is called ‘consumer spending’).

3. What is consumer spending?

Consumer spending is what the people in a society are spending on goods or services. Every time you get your hair done, stay in a hotel, or buy food, you are adding to the consumer spending.

4. What does total employment mean?

Total employment is the number of people with jobs. High employment is good- workers get money (so don’t need government benefits) and also pay tax on what they earn (which is more income for the government). So high employment is good, twice over- and we’ll see high unemployment is bad twice over.

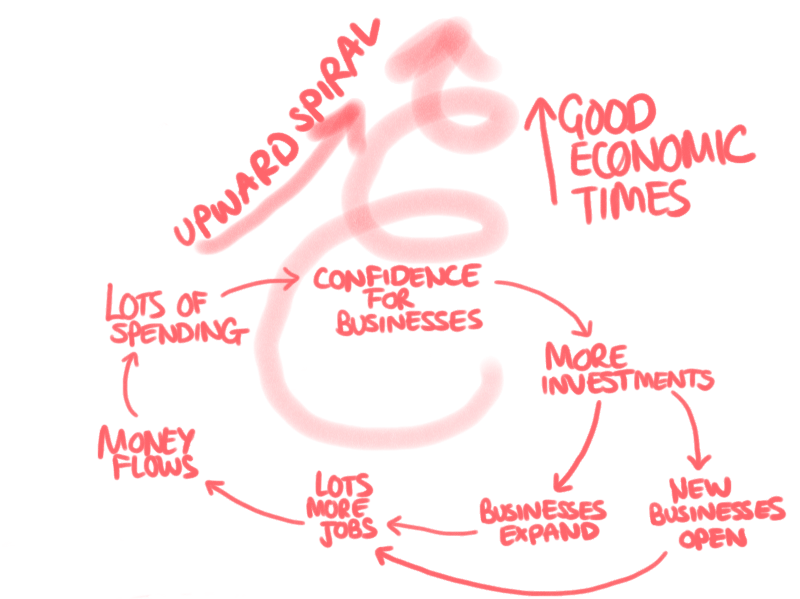

Economic cycle in GOOD times:

In good times, people have money and a sense of security which means they spend money on nice things. Consumer spending means security for businesses too, they are confident that there will be steady sales. This confidence leads to greater investments because of the security of a return on investment (ie on a small scale, if a business buys more stuff, they are likely to sell it and have greater profits- investments are paying off well). Greater investment can involve expanding businesses or opening up new business which creates jobs so employment goes up. This puts more money in the people’s pockets and so they spend more. The cycle repeats. Employment means people are earning more and paying more taxes so the government is also doing well from it (and paying less in unemployment benefits).

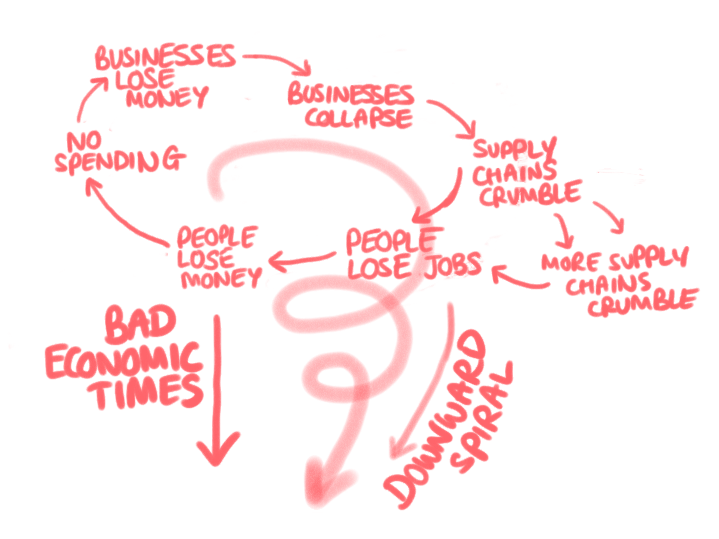

Economic cycle in BAD times:

There is a ‘shock’ and value collapses. Businesses start to struggle- those who are in the worst financial position collapse and often bring down chains of surrounding businesses. Businesses collapsing means people lose their jobs, so unemployment goes up. Investors lose their money and employees lose their incomes. Because people are tight on money, they spend less which means even less income to the businesses they used to buy from. Government have to pay more in unemployment benefits, but also have less income because fewer people are working and paying taxes (and fewer business are are operating and paying taxes)

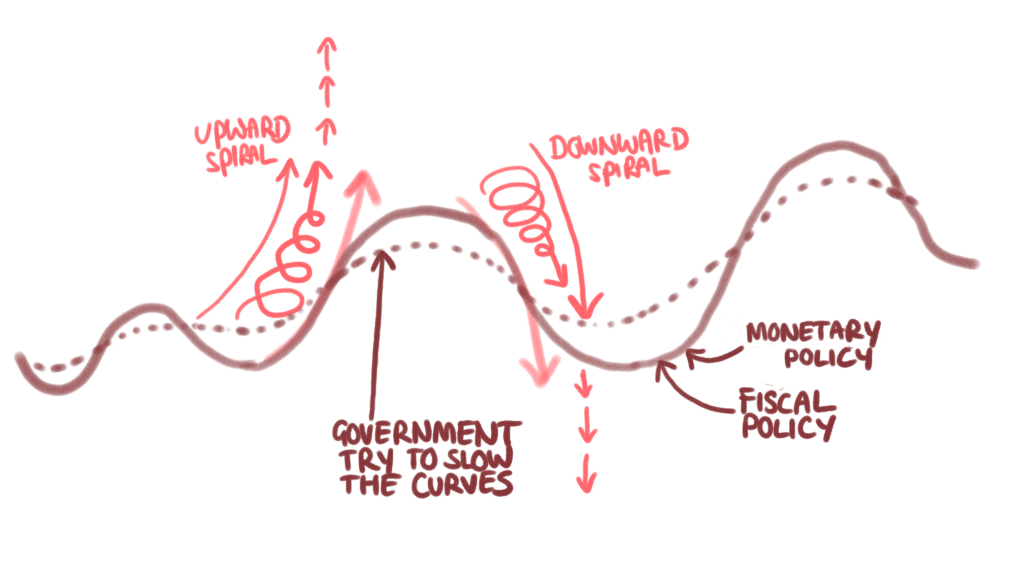

How governments and central banks influence the economic cycles

The government and the central bank are the two big forces that can have influence (but not control) the cycle. They will try and slow the upward and the downward cycles to create more steady growth- one key way they do this is through interest rates. When times are good they will increase interest rates, so ‘lending’ money (by storing it in a bank or investing in businesses) will be a good decision. When the economy needs urgent help from a downward cycle, they will reduce interest rates. This makes holding money in the bank or investing it less appealing as investment won’t make you much return. It means spending becomes more appealing. Boosting spending is a key way to stimulate the economy. Government influences are called ‘fiscal’ policy and central bank interventions are called ‘monetary’ policy.

There is a big question still- when is the moment it goes from good to bad and why? And on the other side, when is the moment it goes from bad to good, and what causes that? Which is the subject of our next post!

Join the mail list or email/comment to say hi! I’d love to hear from you.