This is an easy-going post, no judgement for not engaging with personal finance topic here! Many of my very intelligent friends (with PHDs) do not engage at all with personal finance topics, and that’s completely fine! The only thing that’s a shame, is they believe they have no reasons to invest because they consider it complicated and risky. But it’s not; they’ve just never come by the right resources to learn how to so it simple and safely.

So, here is my rough, basic guide for a beginner. It’s just to get you started with key concepts to consider. And there are plenty of people who have fantastic educational sites which I’ll include below as resources (or see my top resources for investing). But it’s helpful to start somewhere and I hope this is an easy and encouraging place.

What does it mean to invest?

To invest is to put your money into a “commercial venture” in the hope of getting a good return. You could invest in the stock market, you could invest in property / real estate or many super abstract financial products.

Without realizing it, you probably already have money invested. If you have a pension or a bank savings account, you are giving your money to these financial institutions. Have you ever thought about how banks make money? They invest the deposits people put in and make profits, some of which they owe you as interest payments but most of which is their profit. So your money will be somewhere making money for a bank or pension house. So the step to doing it for yourself is really just a tiny jump further.

Main purpose of investing

The main purpose of investing is to grow your money over time. This can happen in two ways. Either the value of the capital you invest in (your shares in companies) increases. Or, you get regular payments called dividends from the investment that you can either live off or reinvest.

To relate this to property investing, capital gainsare like the value of the property going up. The monthly rent payments from tenants in the house would be the dividends.

Is Investing risky?

The safest place to have your money is probably in cash form- strapped to you at all times. The second safest place is probably in a bank and the benefit of the bank is you get a small amount of interest on your money too. There is a tiny tiny risk in banks- what if all the bank’s computer systems fail and they lose record of how much money you have with them? But the risk is so small it’s not worth thinking about.

At the other end of the spectrum, you could invest in a super high-risk stock (something volatile like bitcoin for example). You’ll get a huge return on investment if you time the buying and selling right (i.e. buying when it’s cheap- and selling when you can get a higher price for it). But it’s also high-risk- it could go the other way and you could lose a lot of money.

Between the super-secure cash and bank options, and the super high-risk volatile stock, there are millions of financial products you can invest in that produce different rates of return and different levels of risk- as I’ve shown in the sketch. Generally the higher the return possibility the greater the risk. NO WAY should you ‘gamble’ with your life savings. But investing in low-risk funds is a really good opportunity and I’m about to explain why.

3 Reasons to invest

Three reasons to invest in low-risk stocks:

- Inflation- It’s the only way to prevent your money decreasing in value over time

- Compound Interest- It is an opportunity to grow your money so easily with compound interest

- Economic vote- Your investment is your power and your influence in the global market

Inflation

Over time the value of money decreases because of inflation. If the inflation rate is 2%, the purchasing power of your money is decreasing by 2% each year. If you have money invested in a bank, the best you can hope for in terms of interest payments is about 1%. However,iIf you add the ‘-2’ to the ‘1’, you get an overall loss of 1% per year in the value of money. It’s better than a loss of 2%, but you shouldn’t be losing value in the money you’ve worked hard to earn!

Investing in the stock market, even in very low-risk stocks, brings standard rates of return of 5% to 7% to 8% and slightly higher (but still low-risk) stocks can make upwards of 10%. Even discounting inflation, this is a gain, and it’s a good gain. A small percentage each year makes a big difference overall, as I explain in the compounding section below.

There is a slight caveat- you might have learned about financial management from your parents. In their day, it is likely banks offered much higher interest rates. The economy is very different today! My dad always learnt to save and to put your money in the banks for a return on your investment. For that reason, he never really invested money into the stock market. If your parents are anything the same, they might now have had that experience themselves and that is why they might have different ideas about money. So beating inflation is the first of the three reasons to invest.

Compound Interest

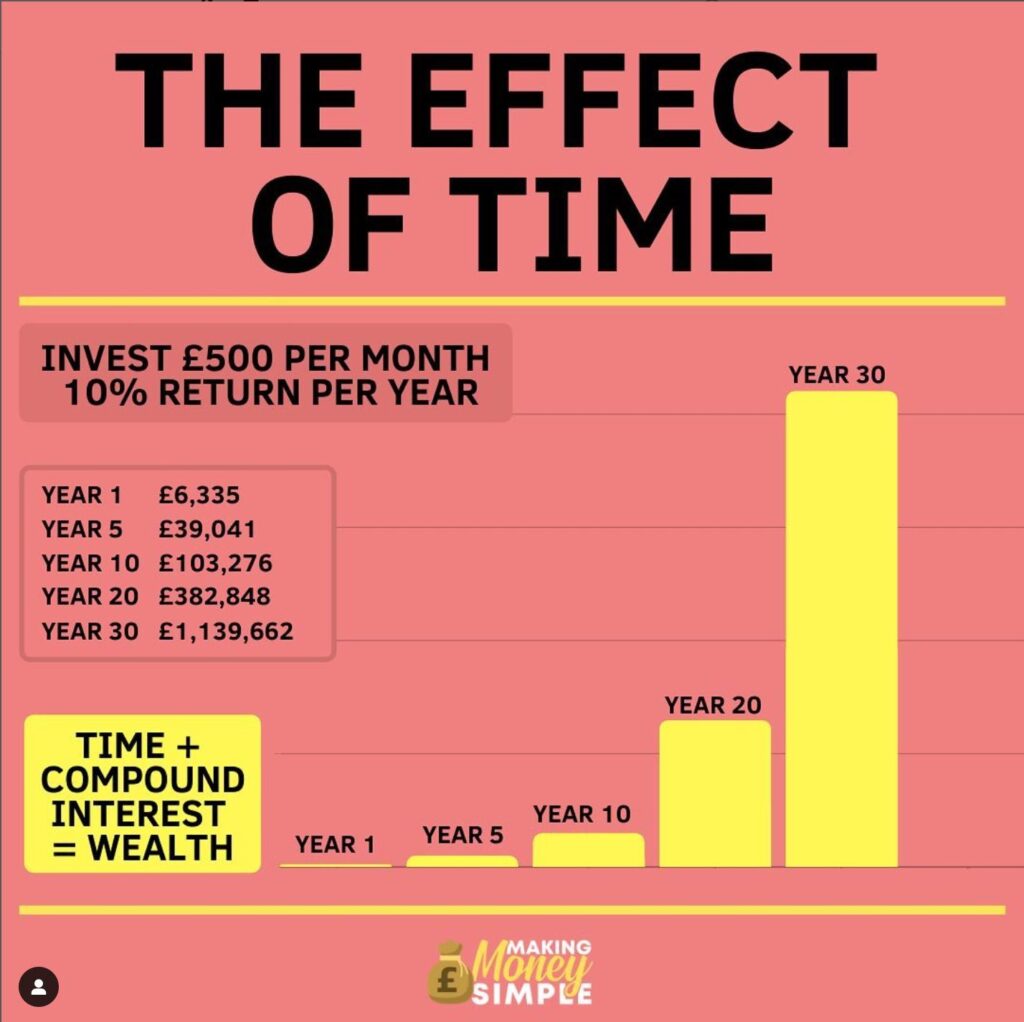

Compound interest is the magic of making money on the stock market. If you invest and let your investments grow over a long period of time, they will become massive! The first time I read about this I thought- yeah but I don’t want to put money aside now for 30 years! I want it to grow now. But then I took a step back and I came to realise the massive potential of this in preparing for a future where you are not a slave to any work. I have taken these gorgeous infographics from a blogger who posts about the impacts of compound interest.

So, the benefits of compound interest are the second of the three reasons to invest.

Your economic vote

By putting your money into a bank and an automatic pension, you’re allowing the banks and pension houses to invest it in anything- arms/ fossil fuel industries, economics with poor human rights. Investing your money in ethical or fossil-free funds is your opportunity to exercise your power in the global market.

Just like with your vote- it’s your right in a free country. Your vote alone is so small, it will make little difference, but it’s your duty to put it behind the ideas you think are best for the society you want to live in. Your investment into the financial market, however small, can support any field you want to support. You could invest in renewable energies or only invest in companies that pay their staff ethically.

For more information on ethical investing- check out this book: Investing to save the planet by Alice Ross.

How to invest your money

Once you’ve decided it’s something you want to do (a very sensible decision btw- well done!), it really is as easy as buying anything online. You set up an account with an investment platform (akin to setting up an eBay account) and then buy funds like you would items on eBay. You can do single purchases or set up monthly recurring investments. Read more on how to invest here.

Benefits on investing in the stock market

So investing in the stock market doesn’t have to be super risky because you can invest in low-risk products. Low risk options include government bonds, exchange-traded funds (ETFs) and index funds. Investing your money stops it from devaluing over time which it does if it sits in the bank and which devalues even more if it sits in a shoebox under your bed.

Investing gives you access to the magic of compounding your wealth over time- which is really powerful. It also involves exercising your power in investing in the financial markets into areas that you believe in supporting.

However, although I think there are a lot of reasons to invest, you should start with a bit of research to make sure you’re following a few key principles that will keep you financially safe as you enter into a new space. They are really easy pointers- they’re in my next post, or you can check out the resources below that I used in learning about investing.

Reasons to invest- Resources

I have a whole other post about resources to learn investing. Below are some other places you can learn the basics:

https://www.barefootinvestor.com/

https://www.ladiesfinanceclub.co.uk/

If this was interesting, my next post is on how the stock market works and how to invest.