Finance and the economy seem to go hand in hand in central London with people in plush suits in tinted glass sky scrapers. But the economy is actually the very real world we trade in everyday, when we buy things, or when we offer our skills and services. ‘Big’ Finance is bad for the economy because it transfers wealth away from the real people who spend their days working, creating societal value.

How do financial systems transfer wealth away from the people?

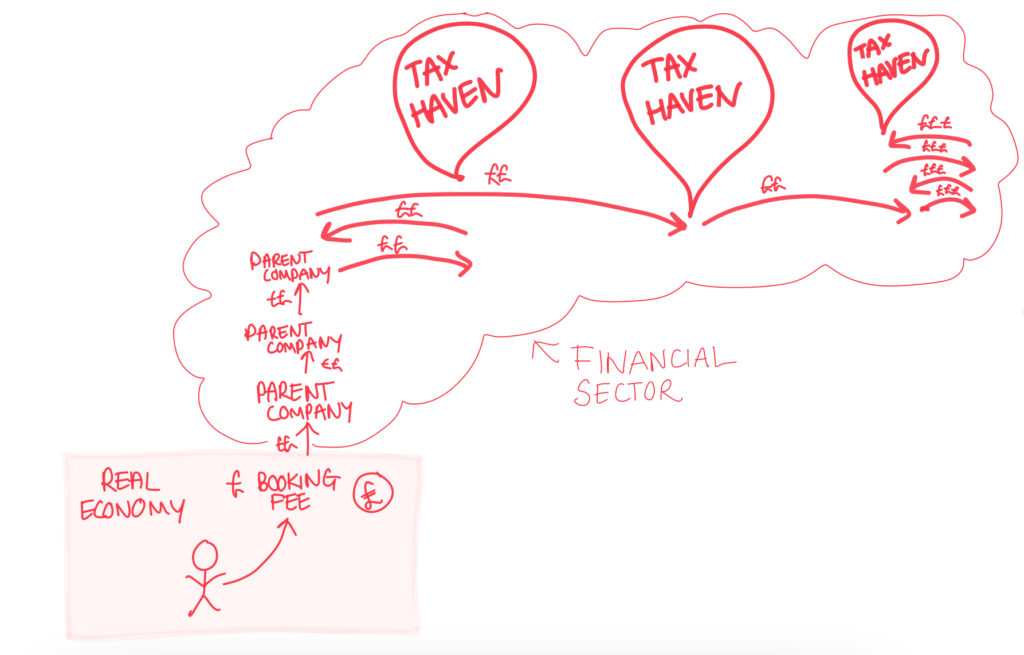

Finance transfers wealth to complex systems of companies, who own other companies and sit in subsidiaries of other countries. Wealth changes hands between many ‘technical’ but not ‘real’ registered companies. Each allows for money to be owed and borrowed, fees to be charged and interest to be earned. These processes generate a huge amount of wealth for the wonders of the companies, but the profits are not paid back down to the real economy through valuable services or taxes. It circulates in the finance world, changing form, but not doing anything ‘useful’ for the majority of people.

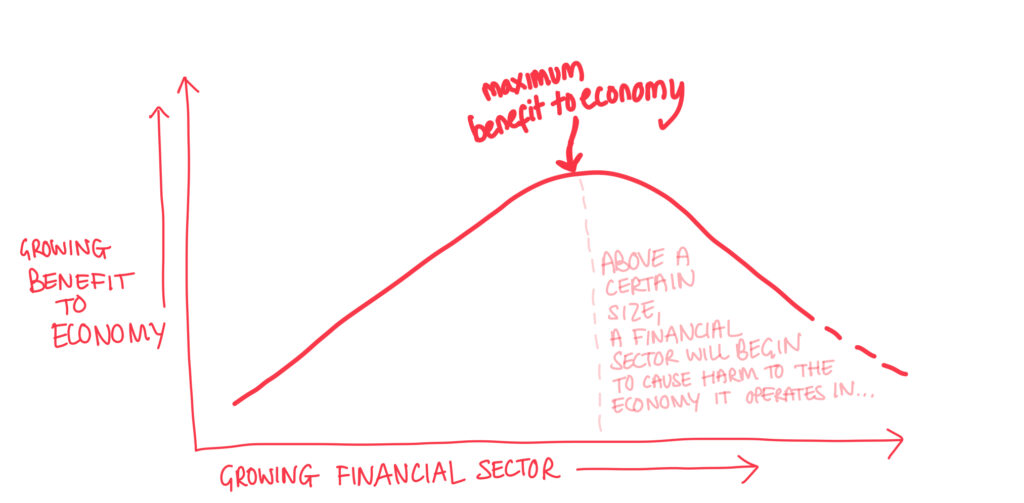

This post will explore why finance is bad for the economy by seeing how the benefits of finance to the economy go from being big, to leveling to, to slowly declining as finance grows. As well as bad for the economy, these huge financial service sectors are also bad for politics society, which I discuss in other posts.

What is the difference between finance and economics?

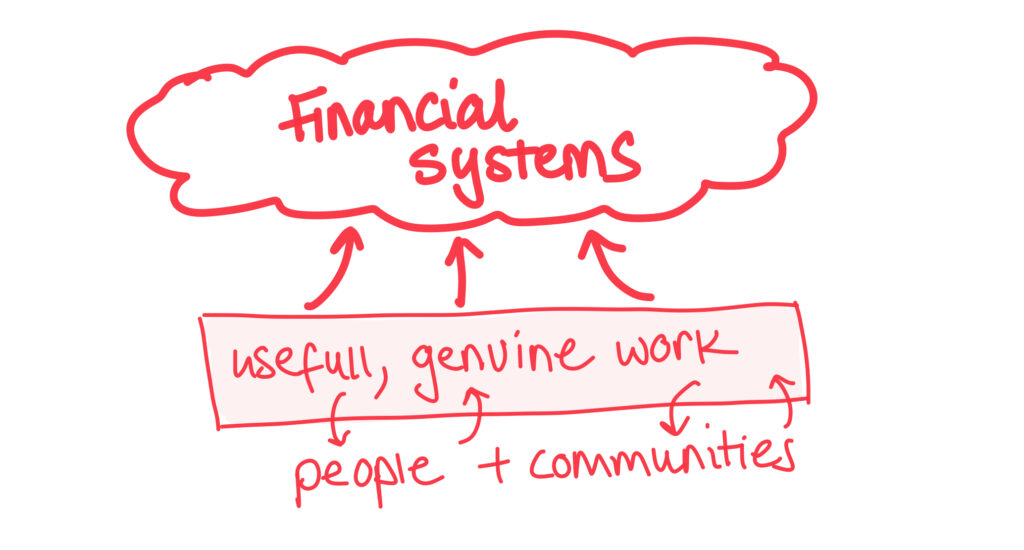

Economics is the study of how goods are produced, valued and exchanged. It is about humans and societal behaviours. Finance on the other hand is the study of the specific tools and instruments we use to manage and exchange money. These products can be loans, credit, insurance, mortgages, savings and investments.

The two are related. SInce the economy is a measure of the flow of money, and finance allows money to flow, finance makes up a key part of the economy. When it becomes too big a part of the economy, it becomes harmful to the real economy.

Why are financial systems good?

Finance is essential to the economy – it allows businesses to get loans so they can produce exciting new products, inventions or enterprises that enrich our lives. We use finance for safety, for example, insurance against ill health, accidents, and employment. Finance includes financial products we all use, like savings accounts, mortgages and ISAs and stocks and share investments. When there is a crisis, the government uses finance tools to sell its debt as government bonds- generating huge amounts of money quickly. In the pandemic they did this to quickly buy emergency medical equipment, and to support those people who could suddenly no longer work as a result of the lockdown.

When charities try to support small businesses in some lower income countries, they offer financial services, such as loans to help them get off the ground. Opportunities for loans and credit are extremely enabling.

The finance sector offers essential services to the people of a country. It is a good thing- until a point. In the UK, that point was past decades ago and since then, the sector has been draining the economy.

When does finance become a problem?

Finance becomes a problem when it becomes too big. Up until a point, like i’ve marked on the picture below, finance allows economies to grow, people to afford to buy things, businesses to invest and expand and flourish. But there comes a point when it stops adding value.

At this point, finance goes from creating wealth for an economy, to extracting wealth from an economy. Money travels upwards into the financial sector, and then travels around, growing, but not travelling back down to the economies it stems from. This generates lot of money for owners of these finance companies, but generating any flow for the people in the country and the services and goods they interact with.

How do finance systems extract wealth from the economy?

A great book ‘the finance curse’ by Nicholas Shaxson explains this by way of a small example that illustrates how big and how crazy finance systems can become. It describes the booking fee charged on an online transport booking service. The booking fee has a value of 50p, which is good value for money as it’s a really easy booking interface, hence why customers pay it.

Trainline, the transport companies, are owned by one company that owns another and another and another. Five companies of ownership up, the booking fee paid in the online transaction travels over to a tax haven in the channel island and then back to London. It then moves to Europe, where it enters the financial streams travelling to a second tax haven, luxembourg. This is only the start of the finance bathway that the ee embarks upon. It travels to the Caribbean, to a number of other Cayman islands company registration account books and then somewhere into the US to giant US investment firms, KKR.

Most of the money made by KKR, as explained by shaxson in the book, comes from re-engineering companies for profit and then selling them off again. KKK may own around 200 real companies, but it also owns 4,000 corporate entities. These include over 800 in the Cayman Islands, 400in Luxembourg and 20 in Jersey.

Why?

At each transaction in these systems, the corporations borrow, lend and sell financial products and money generating more money, but not necessarily adding any real value to any real, working economy. These transactions are all entirely legal, but they are also set up such as to avoid taxation.

Shaxson reports that Trainline, the company, earned £148 million from UK customers in 2017. That, he remarks, is a lot of online booking fees. So the question is, has it also created £148 million of value to UK transport systems. The easy user interface is valuable, but how much value should it represent in the overall snapshot of the UK economy. £10 million? £50 million? What proportion of the 148 million is genuine value added to the economy, and what is just money generated by financial systems.

Why finance is bad for the economy?

Finance, beyond a certain point, begins to extract wealth from an economy rather than generating wealth within an economy. Finance takes money away from valuable services that we interact with. It lines the pockets of corporation owners while diverting it away from circulation where it can be available to fund education, healthcare and vital human services. These are the main reasons that finance is bad for the economy.

The whole finance sector also works so as to perpetuate inequality structures and creates levels of influence that undermine many democratic routes of accountability in the UK.

Thankyou for reaching and reading this post. If you found it interesting, you might enjoy these too:

What is sustainable economics?

Top principles of sustainable economics