Although many people are aware that there is extreme wealth in the world, fewer people know much about the financial systems that control it. In this post: What are the problems with financial systems? I’ll explore the damage that our financial systems are causing to our economy and to our societies.

What are financial systems?

Finance is what we call any scheme that manages and controls huge flows of money. Rather than transactional costs- where you might want to buy an apple and you £1 money in exchange for it, you can think of finance as any scheme to help you get that apple. It could be credit for the apple value, a loan of the amount needed to buy the apple, or an offer of split payments, for example. When you take a loan, sign up for a credit service, or sign up for a ‘buy no pay later’ type of agreement, you will somewhere incur an extra small fee. That is money that does not relate to the fixed cost of the apple, but from the value that the financial service you’re interacting with offers you.

More than just buying and selling apples, our lives are full of financial services. Pensions, insurance, mortgages, credit and loans are all financial services we are used to encountering in our everyday lives. These give us huge value. So some financial services are good, but when economies rely too much on financial services as the biggest part of the economy (as is the case in the UK and the USA), the financial services flow faster and in bigger quantities and take money from the goods and services that provide actual value to our lives.

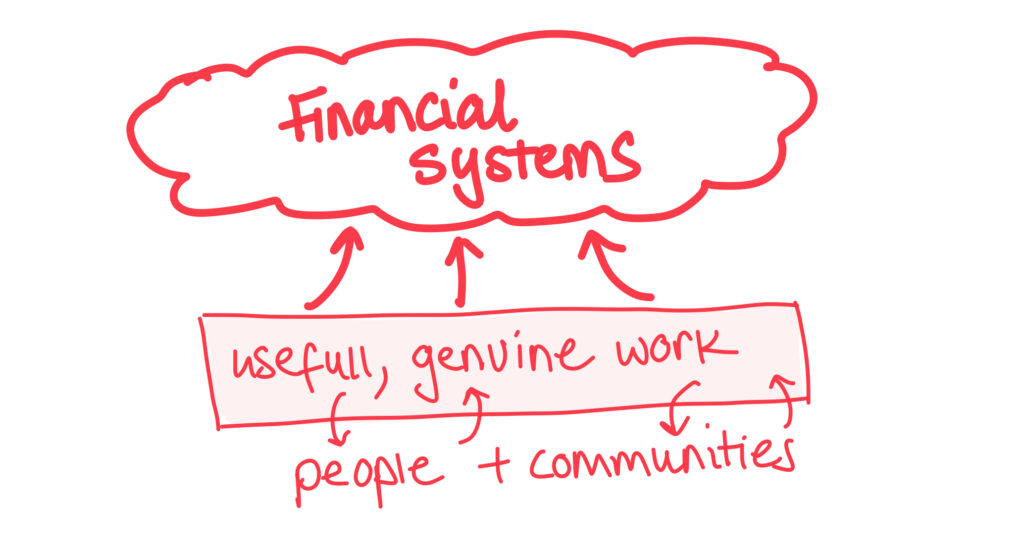

What are financial systems for?

Financial systems offer services that keep our money safe (for example in banks). They offer assurance that we are protected through insurance products. Financial services lend money to invest in businesses, to fund entrepreneurship and human development. They allow us to access things that we could never afford outright, like a house. Financial services allow us to make money by investing in companies on the stock market. They allow countries to borrow money to pay for education, healthcare, or sometimes wars. They are really good when they are regulated.

Why are financial systems bad?

Finance becomes bad, when there is so much of it, that it extracts money flow out of the real economy, and into the finance economy. This extraction allows financial services to flow and generate a lot of money for the people working in those sectors. But it means there is relatively less money flowing around in the real economy that most of us use- with goods and services that provide real value, like shops and hairdressers, and schools and hospitals.

‘The finance curse’ -by Nicholas Shaxson

There is a fantastic book, which was my first insight into the immense problems with our financial systems, called ‘the finance curse’ by Nicholas Shaxson (link). He explains the extremes of how finance creates ‘non-real’ value in a really nice example of the company trainline.

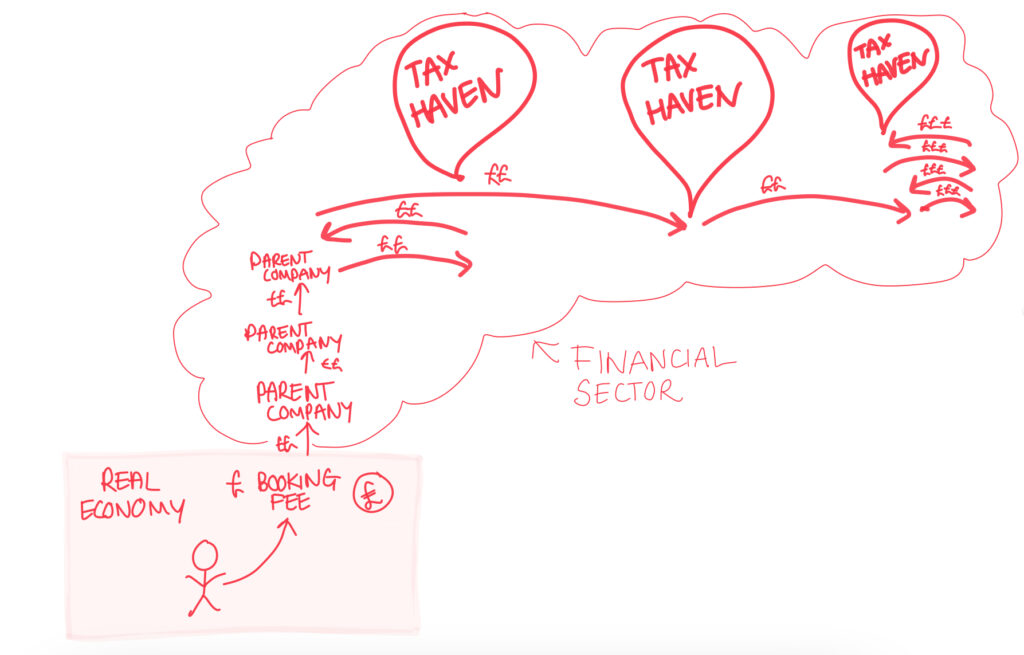

Trainline is an online service that lets you book train tickets anywhere in the country- across different services in one go. It’s really convenient, I use it a lot. And for the convenience of the service, they charge you an online booking fee.

The fee is small- 75p. What then happens to the fee, however, is huge! The company, ‘trainline’ is the only part of the system we know of or interact with, but it is actually just a tiny part of a huge chain of companies. The money flows through all of these companies. They borrow and lend money to each other, generating even more fictitious value flow in the process. The money keeps passing it around, not ‘recording’ it as profit. At some stage, the money flows to companies registered offshore, where no tax can be paid on the incomes, and that is where the incomes are consolidated.

Why is this a problem? It means that the value that we feel is fair to pay for the convenience of the booking service (75p) is not the same as the overall value generated by this process, once all the transactions and processes have taken place.

So something we value as less than £1, is actually contributing much more to the economic flow (and none of that is flowing back down to the people in tax).

Why are financial systems bad for the economy?

Financial systems focus the economy towards the flow of abstract financial products. They reroute the economy away from useful productivity, innovation and entrepreneurship. Finance extracts wealth from the everyday goods and services that run the country; the productivity and talent that leads to new technology; developing solutions to problems like the changing climate; and, developments that will improve the lives of all humans.

Why are financial systems bad for society?

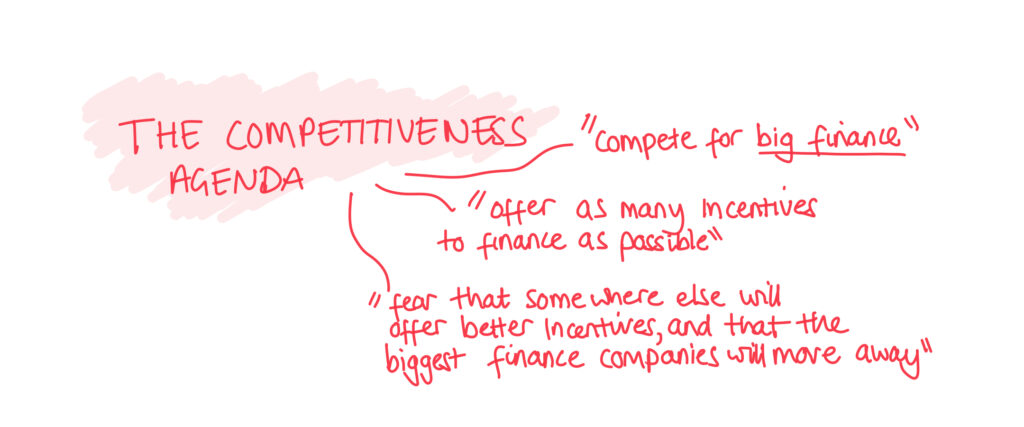

Governments end up supporting financial systems to keep them close. There is a fear, when so much of the wealth flow in the economy is in such uncontrollable systems, that if there was a change and they were to move their company registrations overseas, our economy would crash.

This leads to a dangerous narrative called the ‘competitiveness agenda’. This is the idea that we should not regulate the flow of money in financial services, and that we should keep business taxes extremely low so that these companies want to operate on UK soils, and we thereby have a bit more control over their actions.

The competitiveness agenda would mean we don’t tax corporations fairly for the amount of wealth they generate. It means we allow loopholes so they can do some of the offshore tricks to navigate around further taxes. This leads to money flowing out of the ground economy, and not flowing back as it would in local economies.

Supporting the financial industries and allowing so much money to circulate untaxed- means that when we calculate the value of the financial services industry, we count the money flow and the jobs it provides, but we don’t include the costs. These costs include lost tax income and the cost of economic skew away from an industry that provides real value to our societies. These costs dictate what is left in the budgets that governments have to spend on education, healthcare and social development.

Conclusions: the problems with our financial systems

What are the problems with our financial systems? They skew the economy away from essential activity, such as services and businesses that help the people in this country. Financial services skew money towards constructs where money changes hands between ever wealthier business owners generating them profit, and allowing them to move money around in such a way that they can avoid paying the tax they owe to society. There are many problems with financial services, and more posts coming soon to explore some of these issues and dynamics in more detail.