This post is about the politics in the 2021 budget; what it means and where it comes from. It’s a bit different from my other posts as its more closely related to actual things happening than abstract politics. The budget is where tax plans, spending plans and spending cuts are set out. These are what shapes the future of the country. It’s a big deal, and a particularly big deal following the year of 2020.

What is the budget?

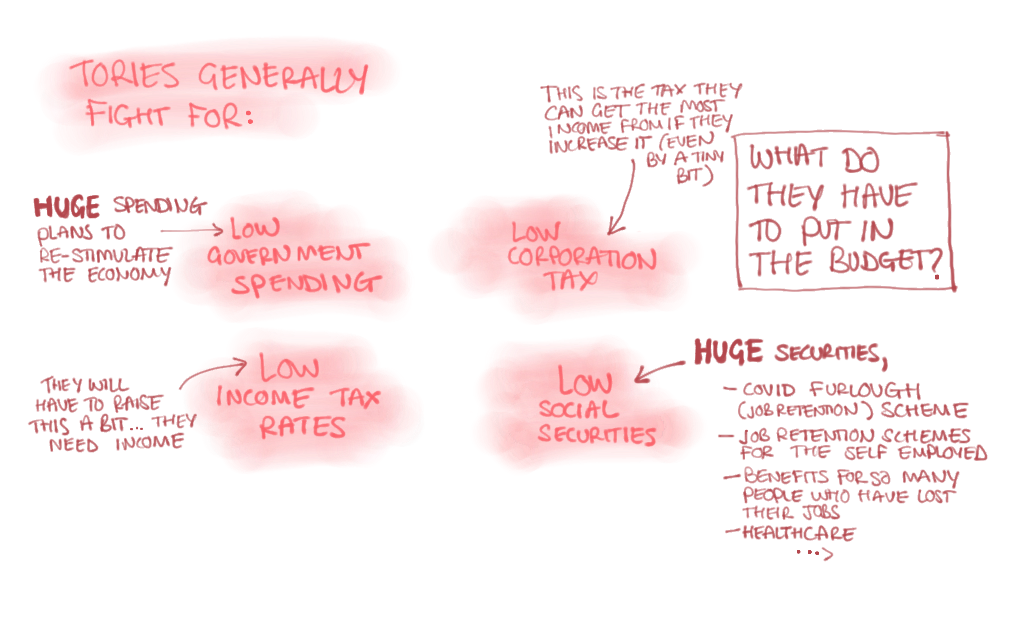

Just ahead of the UK 2021 Budget in March the Government were in a unique position. The Conservative party who are in government stand for a ‘tight’ economy. This means little public spending and low taxes for businesses. The idea is that businesses will be free to thrive and provide enough jobs and wealth that there is no need for public spending. The Tories are usually voted for by wealthier people and business owners as the those are the people who benefit from these policies.

They found themselves in a funny position having in the last year borrowed more money than they could ever have imagined and rolled out the biggest government support schemes they could have dreamed of. They found themselves in a funny position having in the last year borrowed more money than they could ever have imagined and rolled out the biggest government support schemes since the war. The prime minister found himself in a funny position, having just borrowed more money than they could ever have imagined and rolled out the biggest government support schemes they could have dreamed of.

This budget needed to set out how, over the next 5 years, the economy can be brought back into a tight shape and recover some of the huge amounts that have been borrowed. The risk of not recouping the money they have borrowed is that over time with high debt they are more susceptible to interest rate changes. The government raise money through taxation and the tory party fought their election campaign on promises that they would not raise taxes. They were in a tricky position, lets look at the broad 5 year plan and then focus on a couple of little details.

Short term plans in the budget

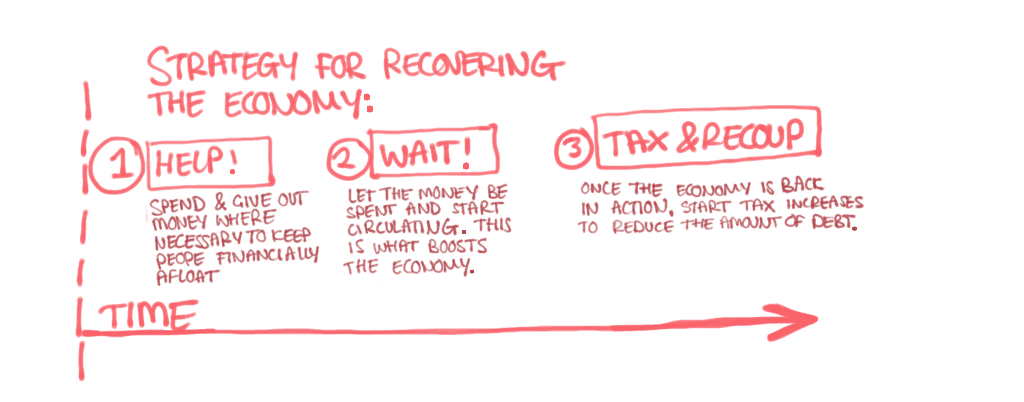

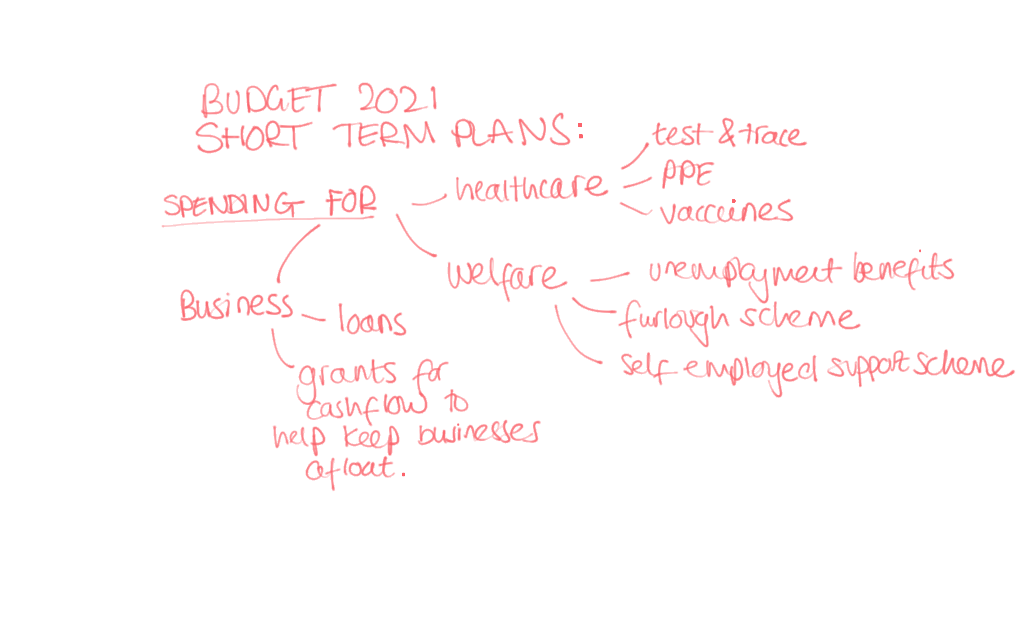

The government will invest a large amount in public services, households and businesses. In the public sector this involves large amounts for healthcare which includes a large amount for PPE, test and trace systems and getting vaccines. For households, there are self-employment income support scheme for all those people unable to work, the corona virus jobs support scheme (furlough scheme) and increased welfare, as many people will still have lost jobs or livelihoods. For businesses these are loans, grants and periods where they don’t have to pay taxes or similar. This is immediate and necessary support and this is continuing as the lockdown continues, or until sectors can begin to re-open.

Medium term plans in the budget

At this stage. The government will need to encourage a huge u-turn in the economy and get it on its feet again. They won’t start raising money, they will leave the money to start circulating and regenerating the economy. During this stage they will want to get as many businesses back on their feet and trading.

One interesting example of one of the incentives they’re offering for this is called super-deduction. The government offer a 130% tax rebate for any big investments such as factors machinery or something like that. This is really huge, you basically pay no tax on big pieces of investment in ‘business kit’ and you get an extra 30% as a little payment and incentive for investing. The hope it that incentivises companies who are in a position to expand to do so as fast as possible, thus creating jobs and gaining large new business to boost the economy.

Long term plans in the budget

The government will then eventually need to begin recovering some of its debt. This is a long-term process (it won’t happen for decades/and truthfully, the government will have reason to go into more debt before that- so it won’t ever happen). Still, while they are in large amounts of debt, they are very susceptible to interest rate rises. If interest rates rise, the yearly repayments on their debts will rise too. Lower debt frees up money that would otherwise have been spent in repayments.

Taxes will be rising. For a government that fought a campaign against tax rises, here is how they’re doing it (sneakily). They will tax profits on businesses (that’s corporation tax) as this is a huge source of revenue. The government needs a lot of money. They have always wanted to keep corporation taxes low on the argument that it incentivises businesses to operate from the UK which is good for employment and the economy. Many multinational businesses operate out of the UK and do provide jobs but pay next to no tax. This corporation tax is unlikely to hit those huge businesses but will hit a lot. Still, the rates will be lower than most of Europe, but just by a smaller margin.

How they’ll do it on the sly…this is ‘politics’

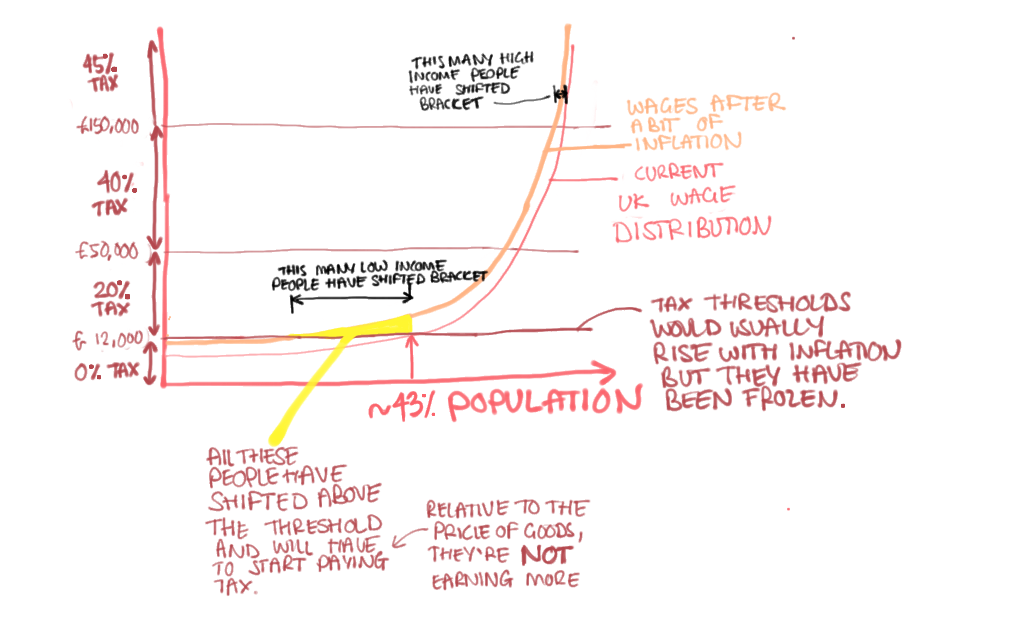

They have said they will not increase income tax, but they will freeze the tax band thresholds. This is politically interesting. It’s a way of hiding quite a significant tax increase for a lot of people who will be moving up a tax bracket due to regular wage increase with inflation. Since promising they would not increase income tax in their manifesto, they are sticking to the promise. However a million people will have to start paying the higher tax rate and 1.3 million of people who were below the tax threshold will suddenly have to start paying income tax. These are low paid workers and this is a significant change and therefore quite a noticeable political call.

Increasing income tax would have proportionally hit the wealthier members of society. Since there is more wealth there to be raised, fewer people would have been affected. The tory government are well linked with wealthy families and stand to protect their wealth, hence why they do not want to make enemies of them.

The thing about freezing a tax rather than getting rid of it is hard to get angry at because nothing is being ‘taken away’ you’re just not getting the regular benefits you’d expect to get.

Problems with the budget?

To understand the opposition it can be useful to look at the key point that are made by the opposition. The key point was that there’s not much of a spending plan beyond the emergency pay outs for the coronavirus. There is no obvious strategy for re-investing in the country to permanently make it more successful, fruitful, skilled and attractive as a destination to bring money to. It seemed still to linger close to budgets from austerity times when spending was always trying to be squeezed and cute, not used as a tool for stimulation jobs and prosperity.

So, in the worst financial crisis since wartimes, this is the direction the government would like to take out of the crisis.

Thanks for reading as ever!

Daniela