This post explains just how the Banks of England controls interest rates. Since influencing interest rates is one of the main tools the Banks of England uses, it’s interesting to see how that works and why they do it. If this sounds good then read on!

The Bank of England trades stocks and shares in a special way to support the economy. Unlike commercial banks (like those on the high street you might bank with), they have different motivations, such as keeping economic activity stable, rather than just acting for profits. They often work against the economic and business cycle I wrote about here in order to keep the economy growing steadily rather than risking periods of very fast growth followed by very fast decline.

How does the Bank of England keep the economy steady?

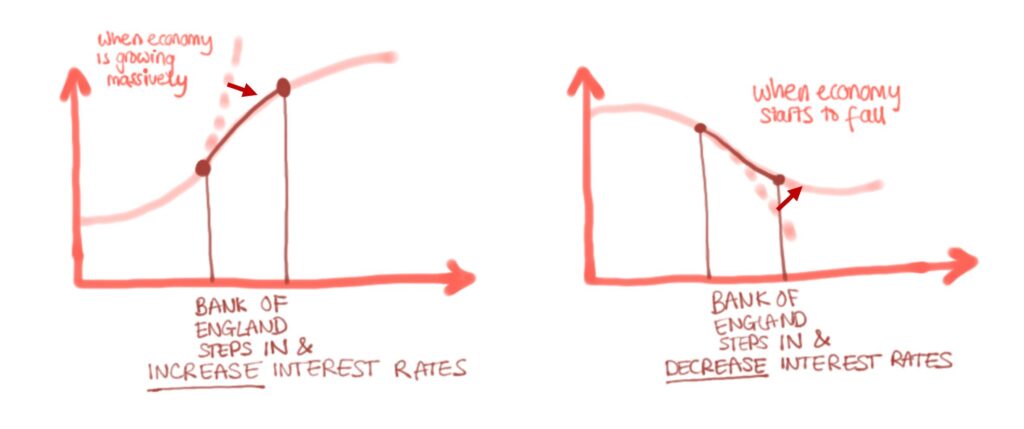

If the economy is growing massively, they will slow the growth a bit to keep it steady. They do this by increasing interest rates to incentivise investment and saving rather than spending. If the economy starts to flatten, they would decrease interest rates to try and get money flowing again and prevent a crash.

The Bank of England tries to keep to a consistent 2% inflation rate. One main aspect of monetary policy (ie the policy set by the Bank of England) is altering interest rates to slow or stimulate the economy. The way they do this is asset purchase. The Bank of England can, in a short space of time, buy up a lot of government bonds from other private sector financial institutions such as high street banks, insurance firms, pension funds etc.

Interest rates are one of the main things the Bank of England use to control Inflation. How does this work and how do they do that?

They have a big power to buy and sell certain types of ‘securities’ (stocks/shares/bonds/debt vouchers) to manipulate the market supply and demand. The ‘market’ is the buy and sell price of financial products. The buy and sell price of an asset are it’s current value. The market is designed to work when every ‘body’ (person or company) that interacts with it, behaves in their own best interest- ie to maximise their own profits. The Central Bank of a country regulates the buying and selling but doesn’t act in it’s own best interest for highest profits. It has another interest it acts in, and that is to slow or boost the economy depending on the situation. Effectively it takes a loss sometimes in order to change the market.

Banks run by holding a small amount of money (10%) of the total money they deal with, in cash for people (or companies) to withdraw whenever they want. Withdrawals are random and on some days a bank might need to have more than 10% but some days it won’t need it’s full 10% allocation. To cover the days when it needs more than it has, banks borrow and lend money between themselves. The cost of this borrowing and lending is like the baseline interest rate that dictates every institution’s behaviour (and ‘behaviour’ means the judgement of risk and return on money).

So the constantly changing daily interest rates are what, when filtered down through the rest of the system, determine behaviours of institutions in the economy and therefore also the economic activity.

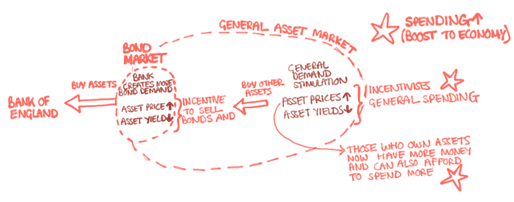

The process (see picture below):

So say the interest rate is a bit high (based on how they want the economy to flow and the inflation to rise) they will strategically buy assets to artificially change the natural supply and demand in the market. (Remember an Asset is general name for a type of financial product like a Bond or a share).

When a bank buys large amounts of an asset, it increases the price of the asset and reduces the assets return. Buyers will look to buy other assets (as the one the banks have bought up are now less desirable), and in turn the price and return of other assets will be affected in the same way; generally over the whole market the prices will go up and returns will go down.

Lower returns on assets for the purchaser means cheaper borrowing costs for businesses and/or households. Worth remembering every change in relative price like this has two sides the effect on the buyer and the effect on the seller (OR we could call it the effect on the lender or the effect on the borrower…it’s the same thing when you’re ‘buying’ chunks of borrowed money). Cheaper borrowing leads to more investments and higher consumer spending which boosts the economy. And that is the mechanism of the Bank of England influencing these factors in the economy.

Also, remember the effect of the Bank of England buying assets drove the asset price up and the asset returns down?. The higher asset price means owners of assets become richer and this also leads to more spending.

(One extra bit)

Another channel of influence the Bank of England has over the economy by purchasing assets is to do with commercial Banks. The cash that the sellers of the assets bought by the Bank of England get are deposited into commercial banks. This gives them more cash (in their 10% reserves which means they are able to hand out more loans (which in the same way as above leads to investment and spending. This is a weaker channel though because banks are still doing a lot of repairing to their stocks following the crisis, meaning less cash filters through the system than it could.

Was this helpful? This is something I’d never understood! I found this Khan academy video quite useful in case you learn well by video too. Let me know if you learnt anything or post a question below/email by clicking the socials icons on the LHS or bottom of the page 🙂 New uploads every Tuesday at 11.00am GMT.