The Bank of England, like central banks for all countries, is responsible for controlling the value of money. Let’s explore what that means by looking at the value of money, inflation rates, trust, confidence and how the bank achieves these things.

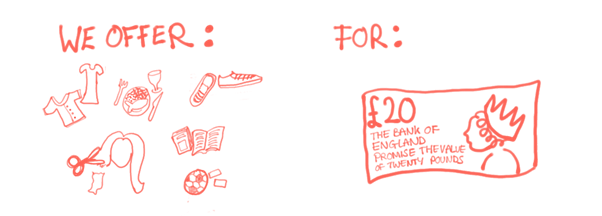

We trade in money based on a ‘promise’ of how much value that money will return. A £20 note is not worth £20 of material (the paper value is probably less than a few pennies). It’s a symbol of a £20 promise. It used to be a promise of £20 worth of Gold when you cashed in the note at a bank. It’s not a promise of gold anymore, but it’s a promise for £20 worth of whatever good you choose to exchange it for (like a food shop, or a haircut).

Who decides the value of the ‘promise’ in a £20 note. For example, who decides if it’s worth a households food shop for a week, or a day, or just a meal? In the past £20 might have been enough to feed a family for a year. In the future it might be enough only for the ingredients for one meal.

The value of money is controlled and maintained by the Bank of England. They do this by:

- Maintaining confidence in the currency

- Maintaining value of the currency

- Stepping in as saviours when there’s a financial crisis

Confidence

Confidence is the thing that people trade in. You want to spend something that retains its value. Imagine buying a house for £500,000 only to find out that the next week the value of the pound has completely changed and if you were to re-sell it, you’d only get £500 back. No one would buy houses with that kind of instability. No one would buy anything (except maybe absolute necessary food) with instability like that. They’d hold their money until prices were at rock bottom which would massively mess up the economy (the flowing interconnected money system of the world). Confidence means that money is hard to counterfeit. Confidence in currency is also the confidence in ‘fair play’ or honour of financial institutions. Basically if you deposit money in the bank and that bank goes under- you want your money insured somewhere.

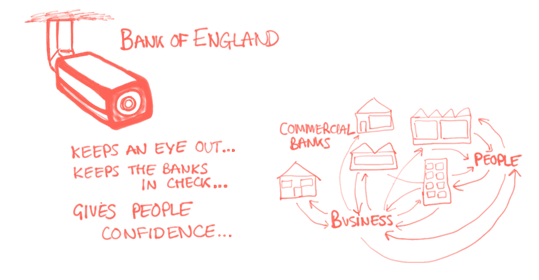

They regulate Banks. To keep the confidence they also ‘control’ in some was the actions of the commercial banks via the policies they set. This is assurance to people depositing money that the Banks will behave well rather than going rogue and gambling off their money. In times of crisis for a commercial bank, the Bank of England will step in to lend them the cash (liquidity). If the economy is struggling, the Bank of England will put more money into circulation to get it moving again. Basically, the Bank of England is a bit like an assurance that Banks are being controlled, will behave responsibly and therefore depositors of money can have confidence in their deposits.

Value

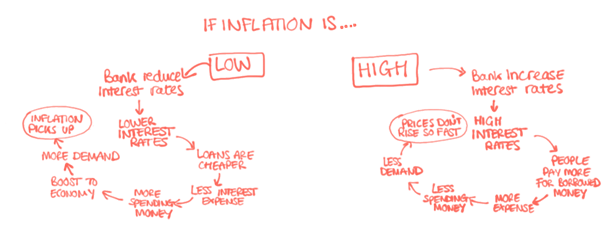

The other things the Bank of England does is to maintain the value of money. In practise the value of money decreases each year because of a mechanism known as inflation. The bank indirectly controls the amount of inflation to keep it at a steady 2% (or as close as possible to that). Their main tool to do this is by changing the interest rates (or ‘Bank rate’). I explain the mechanism of that in another post (click here) but for now let’s just look at the principle.

The interest rates are like the ‘cost’ of money.

When inflation is too high…

If Inflation is high, the Bank will increase interest rates. When interest rates are very high, people pay more for borrowed money. In other words debts that people/companies have become much more expensive which leaves less money for spending (as they have to spend so much on debt fees). Less money for spending means there is less demand and prices will not be able to rise as fast (inflation will slow or start to stop).

When inflation is too low…

When inflation is too low interest rates will be reduced. This reduces the cost of loans. It means less money needs to be spent on loan interest so more money is available for spending. Spending boosts the economy spending it back into a positive upward spiral.

By influencing the interest rates, they’re influencing the ‘cost’ of money to maintain its ‘value’.

These interest rate changes take time to affect change. Because of that, the bank needs to predict what will happen to the economy in the future so it can make small adjustments to interest rates in the present and set the economy on a better course. Often it’ll be predicting events a year or two away so inflation doesn’t stay at exactly 2%, it fluctuates with error. If you like video explanations, there’s a nice YouTube series on the role of the Bank of England here.

Saviours in times of crisis

The Financial system is a massive interconnected web of money flowing, money buying, money borrowing etc. It works when everything flows smoothly. Sudden drops or blockages in the flowing system have big knock-on effects. One little money pot drying up can stop the flow so sometimes the bank will step in. They have the power to materialise money (ie invent it!). They won’t necessarily print physical money bills (even though this is often referred to as printing money) but they will change their balance sheet from (example!) -£100 to -£200 and quickly pour that £100 money into the financial system at the point of stress/blockage in the hope that it filters into the economy and boosts circulation of money. This is a basic description of something called Quantitative easing which governments have been doing since the 2010s. There’s more on this in a Quantitative easing post.

Thanks for reading! Did you find that helpful? Do you have any follow questions? comment below or drop an email, it would be great to hear from you!